A Introduction to Dynamic Investment Theory

and NAOI Dynamic Investments

Executive Summary

This page provides an overview of a new approach to investing that the NAOI will be teaching to thousands of individual investors via our extensive education network beginning in the fourth quarter of 2020.

Called Dynamic Investment Theory (DIT), the new approach was developed by the NAOI based on a multi-year R&D effort to provide our students with a simpler, higher return, lower risk way of investing. DIT sets the logic and rules for the creation of an innovative investment type called Dynamic Investments (DIs) that will play a significant role in the future of investing.

DIs are the financial world’s first “market-sensitive” investment type, capable of automatically changing the equities they hold based on a periodic sampling of market price trends. By doing so they are capable of detecting price uptrends and buying into them while detecting price downtrends and avoiding them. By doing so, DIs consistently producing higher returns than today’s standard MPT portfolios with lower risk and no active management required. You will learn how DIT and DIs work and perform on this page.

Focus groups of NAOI students who have been taught how to use Dynamic Investments tell us that this is the approach to investing that will finally enable them to enter equity markets with confidence and without fear. As more individuals learn about DIs, demand for them will grow. The NAOI shows advisors and financial organizations how to meet this demand via the support resources discussed at the bottom of this page.

Author’s Note: This page has been made accessible to only a select few individuals who I have contacted via a LinkedIn message - it cannot be accessed from the site’s navigation menu. I believe that those who I have invited to view this page will benefit most from the information presented here.

Introductions

Hello. My name is Leland Hevner. I am the President and founder of the National Association of Online Investors (NAOI) an organization I founded in 1997 with the mission of empowering individuals to invest with confidence via objective education and the use of online resources. Thousands of individuals have taken our online courses, read our published books and/or attended our college classes. As a result, we are a major influencer of how the public invests today and the advisors / financial organizations they work with.

As a leading provider of personal investing education to the, the NAOI interacts with individual investors on an almost daily basis. We teach them, but they also they teach us. What we are learning is that individuals are leaving the market in significant numbers.

Why Change Is Needed - NOW

NAOI interviews with individuals who have exited the stock market, or are considering doing so, tell us that at the core of the problem is the unquestioned use of today’s industry-standard approach to portfolio design called Modern Portfolio Theory (MPT). Introduced to the market in the 1950’s, when markets were a far different place, MPT dictates that portfolios be designed to match the risk tolerance of each investor and then held for the long-term, through all economic conditions. There is no alternative to the MPT approach offered to individual investors by the financial services industry today.

A major problem with MPT portfolios is that by using a buy-and-hold management strategy they have no sensitivity to market price movements. This makes them dangerously vulnerable to market crashes that occur on an average of about every 6 years. Thus, investors can expect to lose a significant portion of their portfolio value on a regular basis and it can take months or years to recover these losses.

Yet, after each crash and resultant portfolio losses, financial advisors offer to clients the same static, MPT portfolios that people realize will fail again in the not too distant future. Is it any wonder, then, that many are leaving. or avoiding, the market in significant numbers?

The NAOI Research and Development Project

From our inception in 1997, the NAOI taught MPT methods for portfolio design and management - there were no options available to us. But after watching the portfolios we had taught our students to create melt-down during the subprime mortgage crash of 2008-2009, I suspended all NAOI education classes and opened the NAOI Research and Development Division to find an alternative approach to MPT; one designed to thrive in modern, volatile markets.

Starting with Investor Goals

To understand and define the goals of the investing public we conducted extensive interviews with average investors. Fortunately the NAOI is uniquely positioned to do this as we have direct access to hundreds of individuals who are, or were, NAOI students. We simply asked them what they needed in order to participate in the market with confidence and without fear. In summary form, here are the top three responses:

Simplicity - The vast majority of the public today has little understanding of how investing works and this makes them reluctant to expose their financial futures to the risks of equity markets and third party advice. They want a new approach that is logical, easy to understand and simple to work; giving them the very real option of investing on their own if they wish.

High Returns with Low Risk - Understandably, people wanted higher returns with lower risk than the MPT portfolios they are given today. Many told us that the stress related to investing today is not worth the 5%-7% annual returns they are earning with their advisor recommended portfolios and the threat of major portfolio losses constantly looming.

Absolute Protection from Market Crashes - Of utmost importance to the public was that a new approach to investing provide absolute protection of their portfolio value from market crashes; eliminating a fear that either forces them out of the market or too invest far too conservatively..

It was immediately clear to our research team that MPT met none of these goals. So we started our research with a blank slate, as if MPT had never existed.

NAOI Design Goals and “Thinking-Differently”

Significant research showed that to develop the new approach required, we needed to make the following fundamental changes to how portfolios are designed and managed today:

1. A Better Portfolio Goal. Today’s MPT portfolios are designed to match a “guesstimate” of each investor’s risk profile. And a low-risk rating greatly inhibits a person’s ability to take full advantage of the market’s wealth creation potential. A better portfolio goal would be to maximize returns and minimize risk in all economic conditions. This is a universal goal that works for all investors regardless of their risk tolerance and the need for customization, and its associated risks, goes away.

2. A Buy-and-Sell Management Strategy. MPT portfolios are meant to be held for the long-term regardless of market price movements. This buy-and-hold management strategy makes portfolios dangerously vulnerable to market crashes. A better management approach would use a buy-and-sell strategy that makes portfolios market-sensitive; capable of detecting and buying into market price uptrends while avoiding market price downtrends and crashes.

3. A Built-In, Objective Trading Plan. MPT provides no guidance for making changes to a portfolio once designed other then, perhaps, a periodic rebalancing to revert to original allocations.Equity purchases and trades for MPT portfolios are thus based on subjective judgments and this injects a massive “human-risk” element into the investing process. A better approach would be to build in to each DI a standardized trading plan that signals trades based on objective observations of empirical market data.

4. Eliminating the “Human-Risk” Factor. To eliminate, or to at least dramatically reduce, the investing risks related to subjective human judgments in today’s portfolio design and management process, we saw the need to base equity trades on objective observations of market data as discussed just below.

To meet these goals we needed to start “thinking differently” about how investing works. We started with a deep dive into field of equity market Quantitative Analysis.

Taking Advantage of Quantitative Analysis

As we began to explore the massive world of market data analysis, we found that the following three observations provided us with the information we needed to develop a new approach to investing that met our goals:

1. Asset Classes and Market Segment prices are cyclical, moving up and down at regular intervals. This observation leads to the premise that patterns exist in past price movements that have predictive value for future price movements.

2 Asset Classes and Market Segments prices move up and down at different times. This observation leads to the premise that at all times, in any economic conditions there exists positive returns somewhere in the market.

3. Price Trends are persistent - each lasting for an extended period of time - Historical data showed that bull markets last an average of 14 months and down-trending, Bear Markets, last an average of 14 months.. This leads to the premise that if a price-trend is sampled at relatively short intervals, e.g. monthly or quarterly, the chances of the trend direction detected continuing until the next periodic sampling is high.

Significant testing and data analysis showed to us that each of the above premises was true with a high degree of confidence. This enabled us to create a new approach to investing that we called Dynamic Investment Theory (DIT) that is presented below.

Dynamic Investment Theory

“At all times, in any economic environment, there exist in equity markets areas of uptrending prices. And equities that have moved up in price for a significant time in the past have a high probability of continuing to move up in price for at least a relatively short time period in the future.

A simple, dynamic and internally-intelligent investment type, hereafter referred to as a ‘Dynamic Investment’ (DI), can be created that is capable of automatically finding equities trending up in price and capturing their positive returns potential while also detecting equities moving down in price and avoiding their loss potential. And these actions will be based on observations of historical equity price data with no subjective, human-decisions involved.

It is projected with a high degree of confidence that a Dynamic Investment so designed will be able to produce returns that are consistently and significantly higher than those of virtually any MPT-based portfolio, over the same time period, and with lower risk. It is further projected that Dynamic Investments can be designed that are so simple to understand, implement and manage that individuals of all investing experience levels will be able to take full advantage a DI’s higher performance with minimal education and training required.”

Dynamic Investment Theory Illustrated

The DIT concept is illustrated in the following chart with explanations below..

The vertical lines shown on the top chart represent DI quarterly Review events when it samples the price trends of both a Total Stock Market ETF and a Bond Market ETF to identify the one that is trending up in price most strongly. This is the ONE ETF that it purchases and holds until the next Review event. At the bottom of each Review line is the purchase made with S = Stock and B = Bond. You can see that in Period 4 the ETF price trends changed while the Stock ETF was held. The DI’s value was protected by a Trailing Stop Loss order that sold the Stock ETF with minimal losses and the DI stayed in Cash until the next Review when the Bond ETF was purchased in Period 5.

The bottom graph shows the value of the DI over the time period shown. You can see that DIs are designed to go up in value at all times in all economic conditions. The upward value trend in this example is only interrupted temporarily, in holding period 4, when the asset classes reversed their trend in response to changes in the economic environment. No human, subjective judgments are involved in signaling trades.

Introducing Dynamic Investments

Using DIT logic our next task was to create an optimal configuration for a Dynamic Investment. Our goal was to make price-trend following methods simple, effective and safe for the investing public. We accomplished this goal with the DI design discussed below. An unlimited number of Dynamic Investments can be created using this design to meet a full range of investing goals. But regardless of the investing goal targeted, all DIs have the same components and structure as illustrated in this diagram.

Here is the description of each DI component:

Dynamic Equity Pool (DEP) - This is where a DI designer places two or more ETFs (or mutual funds) that are “candidates” for purchase by the DI at a Periodic Review event as described next.

Review Period - This is how often the DI ranks the ETFs in the DEP to find the one having the strongest price uptrend. The “winner” is the one ETF purchased, or retained if already owned, and held until the next Review event.

Price Trend Indicator - This is the technical indicator that NAOI testing has shown to be the most effective for ranking the ETFs in the DEP by strength of upward price trend.

Trailing Stop Loss Order- A Trailing Stop Loss order is placed on each ETF purchased by the DI to protect its value from sudden and significant price drops during the short holding period between Review events.

Each of these components is a variable that is defined by a DI designer to meet specific investing goals. But the NAOI has found that setting all of these variables as constants except for the ETFs in the DEP works extremely well and greatly simplifies the design process. The NAOI teaches classes on the art and science of DI design and also offers a catalog of optimized Dynamic Investments for a full range of investing goals as discussed at this link.

The Performance of a Simple Dynamic Investment; 2008-2019

Do Dynamic Investments work as predicted? The answer is a resounding YES. The table below shows the historical performance of the simplest possible DI that holds only a Total Stock Market ETF and a Total Bond Market ETF in its Dynamic Equity Pool (DEP). The DI reviews the price trends of each ETF on a Quarterly basis and purchases, or retains if already owned, the ETF having the strongest price uptrend for the past Quarter.

Shown in the table are the Compounded Annual Returns for the DI compared to those of a generic 60% Stock / 40% Bond, buy-and-hold MPT portfolio. Average Annual Returns and the Sharpe Ratio for the entire period are shown in the bottom two rows.

During this period, the Dynamic Investment held the Stock ETF for 1694 days and the Bond ETF for 1327 days. Trades were signaled based on objective observations of empirical market data, with no human judgments involved. Note that the DI made exceptional gains during the market crash of 2008-2009 by switching its holding from the Stock ETF to Bond ETF at the beginning of the crash and then back to Stocks when the market recovery began.

An Enhanced Dynamic Investment

The above DI example was as simple as it gets, holding in its DEP only 2 ETFs - one for Total Stocks and one for Total Bonds. And the returns were amazing. But higher returns without higher risk are possible by simply adding more and different ETFs to the DEP. An “enhanced” DI that adds to the Simple DI’s Dynamic ETF Pool an ETF that tracks a Small Cap Growth index and an ETF that tracks a Long-Term Government Bond index produced the performance shown below. You can see that by adding these carefully selected ETF that average annual returns increased significantly as did the Sharpe Ratio - meaning that additional returns were achieved without additional risk!

Meeting Investor Goals

This examples discussed above show that with the development of Dynamic Investments the NAOI has met the goals set for us by the investing public. DIs are simple to implement and manage, they produce returns significantly higher than MPT portfolios with lower risk and they provide absolute protection from market crashes.

Dynamic Portfolios: The NAOI Recommended Investment Vehicle

While a single Dynamic Investment, such as the one used in the example above, can be used as a total portfolio, the NAOI knows that allocating 100% of an investor’s money to one ETF at a time will not be easily accepted by either individuals or financial professionals. So, the NAOI is teaching individuals to use DIs as building blocks in the more familiar MPT portfolio format.

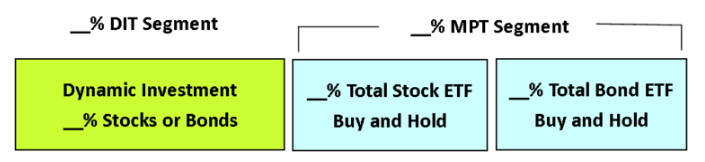

We call these Dynamic Portfolios. They are configured as shown below:.

DPorts have both a DIT, buy and sell Segment and an MPT, buy and hold Segment. It is up to the DPort designer to assign the allocation of money in four areas as shown above. We have found that the higher the allocation to the DIT segment the higher will be the performance of the DPort. We also found that this configuration that holds either two or three uncorrelated ETFs at any one time ( two if the DIT segment holds the same ETF as the MPT Segment) is acceptable to individual investors.

A Universal Portfolio for All Investors

Just imagine. What if an investment portfolio existed that worked for all investors without the need for customization? What if this portfolio produced returns significantly higher than those held by most investors today, with lower risk and absolute protection from market crashes? What if this portfolio automatically signaled trades without the need for subjective judgments of market analysts and investing advisors? And what if this portfolio was so simple to use that people could implement and manage it on their own using an online broker? If such a portfolio existed the world of investing would change at a fundamental level, and for the better.

Well, the fact is that this portfolio does exist. Developed by the NAOI based on extensive testing it is called the NAOI Universal Portfolio. Its configuration is shown below:

NAOI Universal Portfolio Performance 2008-2019

The table below shows the performance of the NAOI Universal Portfolio for the period from 2008-2019.

This is the portfolio configuration that the NAOI suggests that our students consider as either a total portfolio or as the core of a more extensive portfolio. Individuals and/or advisors can easily add other investments to this configuration. However, it would be difficult to beat the performance shown above. Click here for more information related to Dynamic Portfolios.

A Non-Disruptive Enhancement

Some advisors my say that the type of portfolio shown above is too disruptive to current operations to consider. But a Dynamic Portfolio can be designed to in such a manner that simply increases returns and lowers risk for traditional advisor-designed portfolios as illustrated below. In which case, DIs can be seen as a powerful enhancement to current operations as opposed to a disruption.

FOUR Portfolio Diversification Factors!

An amazing feature of the Dynamic Portfolios discussed just above that while today’s MPT portfolios use two diversification factors, NAOI Dynamic Portfolios use four. They are as follows:

Company Diversification - via the use of ETFs (used by MPT and DIT)

Asset-Class Diversification - by working with multiple asset classes (used by MPT and DIT)

Time Diversification - due to the DI’s periodic reviews and potential changes in the equities held used by (used DIT only)

Methodology Diversification - by using both MPT buy-and-hold methods and DIT buy-and-sell methods (used by DIT only)

It should be noted that the first two diversification elements listed above, used by both MPT and DIT, reduce risk but also reduce returns. Diversification elements 3 and 4, used only by NAOI Dynamic Portfolios, not only reduce risk but also enhance returns! The use of four diversification elements in a portfolio is truly an evolutionary step forward in the world of investing.

The Benefits of Using Dynamic Investments

You have seen above that the use of Dynamic Investments enables investors to achieve higher returns with lower risk. But there are other benefits of using DIs that are equally valuable for BOTH individual investors and investing professionals. Listed below are just a few of the top benefits for each. More are found on this Web site by clicking the links provided.

Top Benefits of using DIs for Individual Investors

Simplicity. DI provide investors with a simple, logical approach to investing that people of all experience levels can understand without extensive financial education. DIs are so simple to implement and manage that individuals can take advantage of them on their own using an online broker.

Higher Performance. The DIT approach provides users with higher returns with lower risk than MPT portfolios in all economic conditions.

Lower Stress Investing. DIs provide users with absolute protection from market crashes. This benefit alone will bring thousands of individuals into the market who are now on the sidelines in fear.

Elimination of the Human Risk Element. By basing trading decisions on objective observations of market data, DIs eliminate a massive area of human-risk that investors must deal with today.

Click this link for more: Benefits for Individual Investors

Top Benefits of using DIs for Investing Professionals

Better Products, More Clients, Higher Revenues. DIs enable financial organizations to easily create and offer a full product line of new, higher-performance investment products by simply combining existing ETFs in the Dynamic Investment structure. These unique, dynamic offerings will attract new clients, open significant new revenue streams and provide advisors and organizations with a significant competitive advantage in a crowded market.

Uncovering Hidden Value In Current Product Lines. DIs monetize combinations of existing ETFs. By doing so, they easily uncover massive hidden value in existing ETF product lines that is now lying dormant.

The Productization of Investing! Dynamic Investments have a universal goal that works for all investors regardless of risk profile. As a result, financial organizations that create proprietary DIs can sell them directly to financial advisors AND to the investing public as complete investing products. This is the Holy Grail of investing!

A New Field of Product Development. The DIT approach to investing opens a vast and virgin area of new product development - more information on this topic is found at this link

Click this link for more: Benefits for Investing Professionals

The Basic DIT/DI Books

click to enlarge

The NAOI has created a substantial support system for the design, creation and use of Dynamic Investments and Dynamic Portfolio. One element of this support system is the availability of the two books pictured at right - one for investing professionals which is available on this site in the NAOI Store and one for the investing public that will be available soon on this site as well as on the Amazon publishing platform soon.

These publications show both buyers and sellers how Dynamic Investment Theory and Dynamic Investments work and how to use them to take full advantage of the wealth creation power of equity markets. Each is only about 70 pages long and both are easy to read and understand.

Advanced levels of DI education include NAOI Seminars and DI Design Classes as discussed at this link.

There Will Be Skeptics

As you read the information on this page, you may have doubts. I know I would if reading it for the first time. An entire chapter in the “Introduction to Dynamic Investments and Market Sensitive Portfolios” book, pictured above, is dedicated to addressing these doubts. Below are the top reasons why people tell us that DIs can’t possibly work and a summary of our response to each:

The use of DIT methods will result in short-term capital gains taxes. Yes, the DIT buy-and-sell strategy will result in holding equities for less than a year, resulting in short-term capital gains taxes. There are two reasons why this is not a problem. First, most investing done by the public today is in retirement accounts in which gains are not taxed until money is withdrawn, starting a age 59 1/2, and then at personal income tax rates. Second, the significantly higher returns produced by DIs and DPorts, as illustrated in the examples above, more than make up for any additional taxes.

It is impossible to time the market. The use of trend-following methods can be seen as “timing the market” and experts will correctly say that you can’t time the market with any degree of accuracy. But DIT doesn’t ask you to. DIT makes trades based on observations of historical price trends. And extensive testing shows that past price trends have remarkable predictive power for future price movements, at least in the short term. So, yes, it is true that YOU cannot time the market; but MARKET price-trends can.

There are already momentum products in the market - this is nothing new. The NAOI is well-aware of momentum and factor-based ETFs in the market. In fact, we use some of them in our Dynamic Investment designs. But the NAOI is introducing far more to the investing world than several trend-following ETFs. We are offering the logic and a platform that enables the easy creation of an unlimited number of price-trend following investments that can meet a wide spectrum of investing goals. And the DIs created using the NAOI platform will provide far higher performance than the momentum-based products available in the market today.

The financial industry will not accept a change this big. The financial services industry does not accept fundamental changes easily and many in this arena will oppose those suggested here. There are two responses to this objection. First, the change is not huge when DIs are simply used as building-blocks in traditional MPT portfolios as discussed above on this page. Second, DIT creates investment products that are so superior in performance to MPT portfolios that financial organizations that offer them will have a massive competitive advantage over those that don’t.

There will always be skeptics, doubters and those resistant to change. But consumer demand for the superior performance of Dynamic Investment and Dynamic Portfolios in a competitive marketplace will force financial organizations to accept and offer them in order to survive.

Working with the NAOI

The NAOI offers to financial advisors and organizations multiple options for working together. They are discussed below.

NAOI Consulting

The NAOI also offers Consulting Agreements that show financial organizations how to use DIT methods, Dynamic Investments and Dynamic Portfolios to capture market share, increase revenues and meet their unique goals. Here are several examples:

For ETF Developers and Vendors: If your organization develops or offers ETFs we can show you how to combine them in DIs that produce significantly higher returns with lower risk than any standalone ETF or MPT portfolio in existence today. By doing so, the use of DIs uncovers massive value that is currently “hidden” in your existing ETF product line. And you can double or triple the size of your product line virtually overnight with help from the NAOI.

For Portfolio Strategists and Designers: If your organization designs and/or manages portfolios we will show you how your job just got a lot simpler and your portfolios a lot more profitable with less risk via the use of Dynamic Investments. DIs enable the creation of Dynamic Portfolios that will outperform any MPT-based portfolio in existence today. We can show you how.

For Financial Advisors: Dynamic Investments give you the tools needed to provide clients with higher return, lower risk portfolios as discussed above. And because DIs signal trades based on objective observations of market data, they provide the built-in trading plan - that can easily be automated - that your clients need to take gains and avoid losses. And you can simply forget about the complexities of periodic portfolio rebalancing - DIs do it automatically. In addition, the use of DIT methods and DIs is so simple and effective that you will spend far less time designing and managing client portfolios. This is time better spent providing financial planning knowledge to your clients; an area of wealth creation that individuals desperately need and will be happy to pay for.

For Retirement Plan Providers: A large number of NAOI students are people who are investing in Retirement Plans. When we review their portfolio they are all over the map. Some are too risky while others are too conservative. And a major flaw in them is that their advisors unnecessarily increase allocation to Bonds the closer they get to retirement age - a time when they need income the most. The NAOI has created the perfect Retirement Portfolio in the form of our Universal Portfolio described above on this page. It provides the high returns with low risk that individual retirement plans need. Via a Consulting Agreement we can show Retirement Plan Providers how to capture a large share of this very lucrative, and competitive, market.

The ROI of an NAOI consulting contract will be off-the-charts high. We guarantee it. More information is found at this link.

Advanced NAOI Dynamic Investment Education Classes

Dynamic Investments are easy to create and implement. The NAOI designed them specifically to be that way. But creating optimal DIs that produce the highest returns with the least amount of risk in virtually all economic conditions requires additional training. To gain an in-depth understanding of DIs and DI portfolios and to master the art and science of DI design, the NAOI offers advanced DI Education and Design Classes and Seminars as discussed at this link.

NAOI Partnerships

A recent survey by the CFA Institute showed that on 23% of individuals trusted their financial advisors. Having worked with and taught the investing public for over two decades, the NAOI is not surprised. People know that advisors are also salespeople and this can lead to biased investment product recommendations. A Partnership with the NAOI can immediately allay these fears as we are recognized by the investing public as a strong advocate for the individual investor. Any of the Partnerships described below can immediately increase your “trust factor.”

Here are the Partnership types currently offered by the NAOI.

Strategic Partnerships

With a Strategic Partnership a financial organization will have access to the NAOI’s unmatched knowledge and understanding of the investing public. Based on 20+ years of teaching and working with individual investors, we know what investors want and need from the financial services industry to enable them to participate in the market with confidence and without fear. This is incredibly valuable and actionable information that our Strategic Partners will be able to use to create and offer investment products that the market will buy.

Education / Academic Partnerships

Via an Education Partnership the NAOI makes available to financial organizations a massive investor education knowledge base and proprietary financial planning calculator set that can be used to quickly create customized education material for our Partner’s products and services. Input from our students has shown us time and time again that investors buy what they understand. .

Marketing / Sales Partnerships

The NAOI can assist your marketing and sales efforts in multiple ways. The NAOI “seal of approval” shows individual investors that your organization is working with a trusted advocate for the individual investor. Of course due diligence will be required by both parties for this type of Partnership. In addition, the NAOI refers individuals to organizations that use our services and offers the products that we teach students to use such as Dynamic Investments and Dynamic Portfolios.

Research and Development Partnerships

Creating new investment products and methods today that are embraced by the investing public is a difficult task to say the least. Mutual funds and ETFs currently exist that follow virtually every index and investing strategy in existence. Plus, the creation and marketing process is incredibly time consuming and expensive. A problem is that all such developments today are confined within the industry-standard MPT “box”.

As you have read on this page, DIT breaks free from these constraints and by doing so opens a vast an virgin world for new product development in the form of Dynamic Investments and Dynamic Portfolios. And this realm of development produces products that provide far higher returns with lower risk than virtually investment product in existence today.

The NAOI is looking for Development Partners to help us exploit the massive potential of this new approach. Financial organizations seeking to expand their product lines, increase their market share, open new revenue streams and gain a massive competitive advantage in a crowded field need look no further than an NAOI R&D Partnership. More information is found at this link.

If you are interested in an NAOI Partnership, contact me personally at LHevner@naoi.org to discuss the possibilities.

Summary

Presented on this Web page is a new approach to investing that the NAOI will begin teaching to thousands of investors in Quarter 4 of 2020. As you can tell, Dynamic Investment Theory and Dynamic Investments are not merely a trading system or fixed set of “momentum” products. This is a comprehensive and evolutionary approach to investing that enables financial professionals to create an almost infinite number of unique and powerful products designed to meet a full spectrum of investing goals.

Dynamic Investing Theory does not simply “tweak” the way investing works today, as do most current Fintech developments, it replaces it with a better, more profitable investing approach for both investment buyers and sellers. This new approach evolves the world of investing to thrive in 21st century markets and will attract thousands of new clients. Financial advisors and organizations that recognize this first, and begin planning for it now, will profit handsomely. Those that resist the type of change that the NAOI is creating, will struggle to survive. That’s just how evolution works.

Please feel free to contact me directly at: LHevner@naoi.org with questions or for more information. And consider joining the NAOI Updates Email List via the form at the bottom of this and each page of this site. I look forward to discussing with you the once-in-a-generation opportunities that now exist and how we can cooperate to meet our common goal of empowering the investor - both individual and institutional. And by doing so to also give your organization a massive competitive advantage in a crowded field.

"the future of investing starts here" is a registered trade mark of Leland Hevner and the national association of online investors