Empowering Individuals to Invest

with Confidence, with Success and without Fear

Welcome to the website of the National Association of Online Investors (NAOI), a unique organization that works with both the investing public and the financial services industry to meet the goals of each.

Established in 1997, the NAOI is the authoritative leader in providing comprehensive, objective, and actionable investor education to the public. Thousands of individuals have engaged with our online courses, explored our books, and attended our college classes. As a result, we are a powerful force in shaping how investors choose their advisors.

Based on 25+ years of teaching and working with investors, the NAOI has an unmatched understanding of what the investing public wants and needs from the financial services industry to enable them to enter the market with confidence and without fear. We use this valuable information in the following ways:

1. To continuously update our investor education content to enable our students and NAOI members to take advantage of the investing profits that are available in today’s changing markets.

2. To develop innovative investment types and investing methods that provide investors with the returns they want and the strong protections from loss they need.

3. To show financial organizations and investment advisors how to gain a massive competitive advantage in the crowded field of financial services by offering superior investing methods and products.

This Home Page provides an overview of how the NAOI is structured to meet the goals of both investment buyers (our students) and investment sellers (our consulting clients). Links are provided to pages on this site that show more details for each.

Introductions

Hello. My name Leland Hevner. I am the President and CEO of the National Association of Online Investors (NAOI) an organization that I founded in 1997 to teach individuals how to successfully navigate the world of investing.

This goal is met via comprehensive investor education, the use of online resources, and the creation of innovative investment products and methods that better meet the needs of investors than those they are offered today. By combining these components, the NAOI enables our students to capitalize on the profit potential of equity markets with minimal risk.

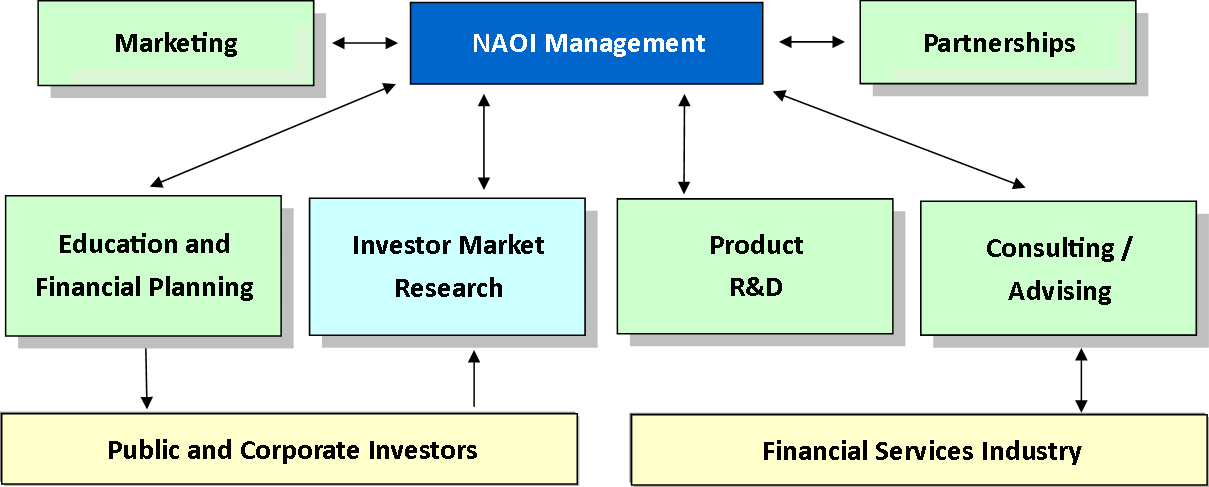

The Organization Chart and the Evolution of the NAOI

Shown below is the organization chart of the NAOI. It has grown and evolved over the course of 25+ years to provide investors with the knowledge and resources needed to navigate the world of investing successfully. The NAOI has evolved significantly since our initial offering of a single investing course in 1997.

The NAOI Divisions

The purpose of each NAOI Division shown in the above chart is described below on this page. Links are included to areas of this Web site where more detailed information for each is found.

The NAOI Education Division

A major problem with investing today is that nowhere in academia, at any level, are individuals taught how to successfully participate in equity markets. They may be taught how investing works, but they are NOT taught how to navigate this complex field in a manner that increases their wealth and avoids significant losses.

The NAOI addresses this problem by offering to the public comprehensive, objective and actionable investor education. The “NAOI Individual Investor Certification Program” that includes the courses pictured below is the gold-standard for investor education today. For more information related to NAOI education go to this link.

the naoi individual investor CERTIFICATION PROGRAM

While not all individual investors need the level of education provided by the above Certification Program, any advisor or financial organization that offers at least a basic investor education course, customized with the help of the NAOI, will hold a massive competitive advantage in the crowded field of financial services. More information on this topic is found at this link.

The Investor-Market Research Division

The purpose of this Division is to listen to and learn from our students who represent a broad cross-section of the investing public. By doing so we have gained an unmatched understanding of how they view the investing world, their wants and their fears. We also know the factors that they consider when searching for financial advisors and organizations to work with.

This incredibly valuable information is used by three NAOI Divisions. It is used by our Education Division to continually update our education course content. It is used by our R&D Division to create innovative investment products and investing methods that better meet the wants/needs of the public. And it is used by our Consulting Division to show financial advisors how to attract far more clients than they do today.

The NAOI Financial Planning Center

The NAOI’s recognizes that Financial Planning is a critical element of wealth creation. As a result, we have created a Financial Planning Center as a part of our Education Division. In this area we provide students with a set of online, interactive financial planning calculators and worksheets that enable them to document their financial profile, set investing goals and take the actions needed to reach their goals.

These proprietary NAOI calculators and worksheets can be accessed for free on this site and are also available for licensing and branding by third parties. This interactive resources will bring thousands of new clients to the Web site of any financial organization that offers them. They can be found at this link.

The NAOI Research and Development Division

For over a decade after our founding in 1997 we took for granted that the only way to build investment portfolios was via the use of a portfolio design and management methodology called Modern Portfolio Theory (MPT). Introduced to the market in the 1950’s, this approach dictates that portfolios be designed to match the risk tolerance of each investor and then held for the long-term, through all economic conditions. A major goal of our education content, therefore, was to teach MPT methods to our students. As time passed, however, we found that this thinking was wrong.

After the market crash of 2008-2009, when the MPT portfolios we had taught our students to create lost significant value, we had to face the harsh reality that static, buy-and-hold, MPT portfolios simply could not cope with modern dynamic markets. It became clear to us that more then education was needed to empower investors; also needed was innovation. With this realization the NAOI R&D Division was tasked with finding an alternative for, or supplement to, MPT methods for portfolio design.

Following a multi-year effort we met this goal in the form of an MPT alternative that we call Dynamic Investment Theory (DIT) and an innovative investment type it creates called Dynamic Investments (DIs) that produces higher returns with lower risk than virtually any investment product being offered by advisors today. They are described in detail in a 60 page NAOI Research Report shown below.

More information is found at this link.

We are currently making pre-release access to this seminal Research Report available to a select group of financial professionals and financial organizations that we believe will benefit most from learning about this 21st Century approach to investing first. To be considered for pre-release access to the Research Report go to this link.

The NAOI Consulting Division

The NAOI Consulting Division was created to share our education content, investor research data and innovative investing products/methods with the financial services industry.

Via an NAOI Consulting Agreement we show financial professionals how to create and offer innovative investing products and methods that better meet the needs of the investing public than those being offered today.

And based on our extensive knowledge of the investing public we show our consulting clients how to market these new investing product in a manner that that will enable them to significantly expand their client base, increase revenues and gain a massive competitive advantage in a very crowded field.

For more information related to NAOI Consulting go to this link.

NAOI Partnerships

The NAOI offers Partnerships to financial organizations that share our passion for empowering individuals to invest with confidence, success and without fear.

Based on 25+ years of working with the investing public we have gained a sterling reputation as a strong advocate for the individual investor. A Partnership with the NAOI will elevate any organization’s “trust-factor” with the investing public. This is a significant competitive advantage in a field where a recent CFA Institute survey showed that only 23% of individual investors completely trust their financial advisor.

We offer Research and Development Partnerships that enable organizations to work with the NAOI to create new products in conjunction with our development team.

More information related to NAOI Partnerships is found at this link.

NAOI Advisory Assistance

NAOI President Leland Hevner is available to join financial organization Advisory Boards. In this role he draws on his 25+ years of working with the investing public to show organizations how to create marketing plans, investing products and investor solutions that will give them a significant advantage over their competitors.

Hevner’s CV is found at this link.

Financial Organizations and Investment Advisors - Let’s Talk

There is absolutely no simpler, quicker or more cost effective way for a financial organization to gain a massive competitive advantage in the crowded field of investing services than by working with the NAOI.

We know what the public wants/needs to participate in the market with confidence and without fear. As leaders in the world of investing education we are well positioned to make our students aware of the financial advisors that offer the innovative investing products and methods created by the NAOI.

Feel free to contact NAOI President, Leland Hevner directly at LHevner@naoi.org, or on LinkedIn to learn more about how we can work together to enable your organization to attract far more clients than you do today.

“The Future of Investing Starts Here” is a registered trademark of Leland Hevner and the NAOI.