Slide Show Index << Previous Next >>

Slide 02:

The Discovery of Dynamic Investment Theory

In 2008-2009, when the MPT portfolios that I, Leland Hevner, was teaching students to create crashed along with the market, I stopped all NAOI investor education activities.

I saw that Modern Portfolio Theory (MPT), the standard approach to portfolio design for over six decades, simply could not cope with modern markets. At that point I refocused NAOI resources from Education to Research and Development in order to find a better approach to investing; one designed specifically to work in modern markets. I realized that the NAOI’s mission of investor empowerment required more than education and the use of online resources, it also significant fundamental innovation.

The Goals for a New Approach to Investing

As we started our research effort I was adamant that a new approach to investing would be designed to meet the goals of the investing public. So our first task was to interview average people with money to invest. Fortunately the NAOI has access to hundreds of individual investors who are either NAOI students or NAOI members. And they represent an excellent cross-section of the investing public. We asked them what they wanted and needed to become confident investors and willing to enter the equity markets without fear. In summary, here is what they wanted.

A greatly simplified approach to investing

Higher returns with less risk than the MPT portfolios they are given by their advisors today

Absolute protection from market crashes

Less reliance on third parties to make trade decisions

A simple and viable “Do It Yourself” investing option using an online broker

We immediately saw that MPT met NONE of these goals. So we started our research with a blank slate; as if MPT had never existed.

The Use of Scientific Methods

From the start, it was obvious to us that the only way to meet these goals was to develop an approach in which trade decisions are made based on observations of historical market data instead of being based on subjective human judgments as they are today. We would NOT create an approach in which the competency / honesty of an advisor was a variable in how well a portfolio performs.

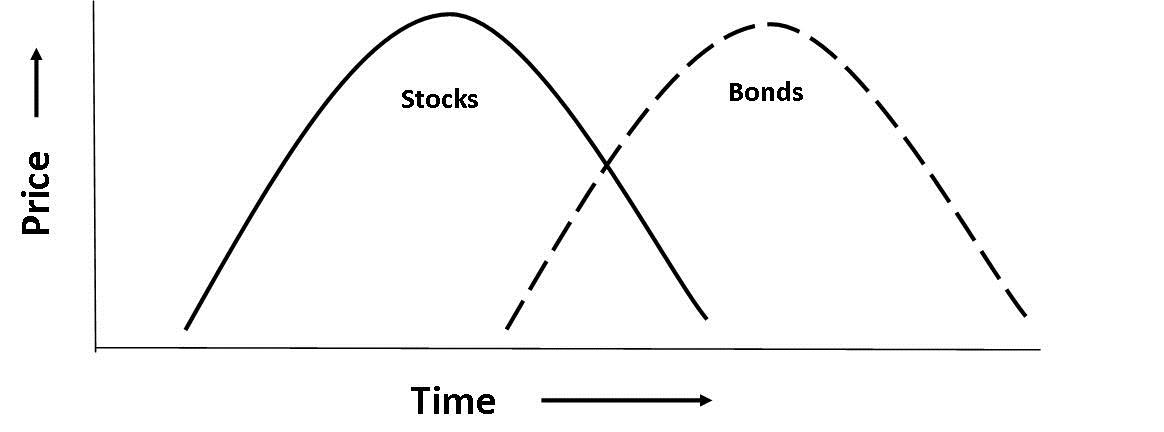

For our goals to be met, we needed to find patterns in historical data that had proven predictive value for future equity price movements. Based on significant research we found what we were looking for in equity price trends. Data analysis showed us that the prices of asset classes and markets are cyclical and that different asset types and different market segments move up and down at different times as illustrated below.

the cyclical nature of asset pricing

Based on this observation and in keeping with the scientific process we arrived at the following Premise:

“At all times and in any economic conditions there exist areas of the market that are trending up in price. It is possible to create an investment type that is capable of automatically detecting these areas and capturing their positive returns potential while avoiding areas of the market that are trending down in price.”

Testing and Creation of a Theory

Again using scientific methods, our next task was to create prototype investment designs to test our Premise. Significant effort in this area resulted in one design that showed it to be true with a high degree of probability. We called this new investment type NAOI Dynamic Investments (DIs). And based on our testing results we transformed our Premise to a Theory that we called Dynamic Investment Theory (DIT). It met every goal set for us by the public and more, as you will see on upcoming slides.

Breaking New Ground

The NAOI understands that the observation that equity prices are cyclical and that uncorrelated assets move up and down at different times is not a new discovery. Market cycles and momentum investing have been studied and used for years.

The significant breakthrough that the NAOI made was the design of a new investment type called Dynamic Investments (DIs) that simply and automatically transformed equity price cycle information into profitable investing actions. This is not insignificant. DIT and DIs bring high-return, low-risk investing methods that are, today, almost exclusively in the realm of hedge funds, directly to the people in a simple and user-friendly manner.

Empowering Individual Investors - Our Mission

Dynamic Investments meet every goal set for us by the public as listed above. This new investment type and management process will enable millions of people to confidently enter the market who are now on the sidelines in fear. Financial organizations who recognize the power of DIs, make the effort to understand them via an NAOI consulting contract and include them in their strategic plans will hold a massive competitive advantage in the future of investing. The following Slides show how.

Next >>