Welcome to the Web Site of the National Association of Online Investors,

A Unique Organization that is Creating a More Profitable Future of Investing

for both Investors and the Financial Services Industry

The National Association of Online Investors (NAOI) is the market’s premier supplier of comprehensive, objective and actionable investing education to the public. We are also a leading developer of innovative investing solutions that will bring thousands, if not millions, of investors into the market who are now on the sidelines in fear. And via our Consulting Division we show the financial services industry how to capture this new prospective client base.

On this Web site you will learn about the NAOI’s extensive investor education offerings as well as a new approach to portfolio design and management called Dynamic Investment Theory (DIT). Created by the NAOI based on a multi-year R&D project, using extensive input from the investing public, DIT sets the logic for the creation of a new, powerful investment type. Called Dynamic Investments (DIs), they consistently produce higher returns with lower risk than virtually any MPT-based portfolio with the added benefit of providing absolute protection of portfolio value from market crashes. This is the investment type that NAOI students tell us will finally enable them to enter the investing arena with confidence and without fear.

This Home Page introduces the NAOI and shows how our organization is uniquely structured to define and implement a more user-friendly and profitable future of investing. Links are provided to more details related to each topic discussed.

“The Future of Investing Starts Here” is the tag line and a registered trademark of the NAOI.

Introductions

Hello, my name Leland Hevner, President and CEO of the National Association of Online Investors (NAOI) an organization that I founded in 1997 with the mission of empowering individuals to invest with confidence and success via education and the use of online resources.

Thousands of individuals have taken our personal investing online courses, read our published books (Wiley is one of our publishers) and/or attended our college classes.

As a result, we are a major influencer of how people invest today as well as the financial organizations they choose to work with.

The Current NAOI Mission StatementThe single goal of our original, 1997, Mission Statement was to empower investors via education and the use of online resources. However, based on over two decades of working with the investing public our Mission Statement has expanded to include two additional goals as listed below.

The current goals of the NAOI are to:

1. Empower individuals to invest with confidence and success via comprehensive and objective education along with the use of online resources.

2. Develop new investing methods and innovative investment types that enable investors to take full advantage of market gains while avoiding market losses in a simple, safe and profitable manner.

3. Show investment advisors and financial organizations how to better meet the wants and needs of the investing public. By doing so, to enable them to expand their client base, increase revenues and develop significant competitive advantages in a crowded market.

Via these goals, the NAOI is defining a better future of investing for both buyers and sellers. This Web page and this Web site show how the goals of our mission statement are being met.

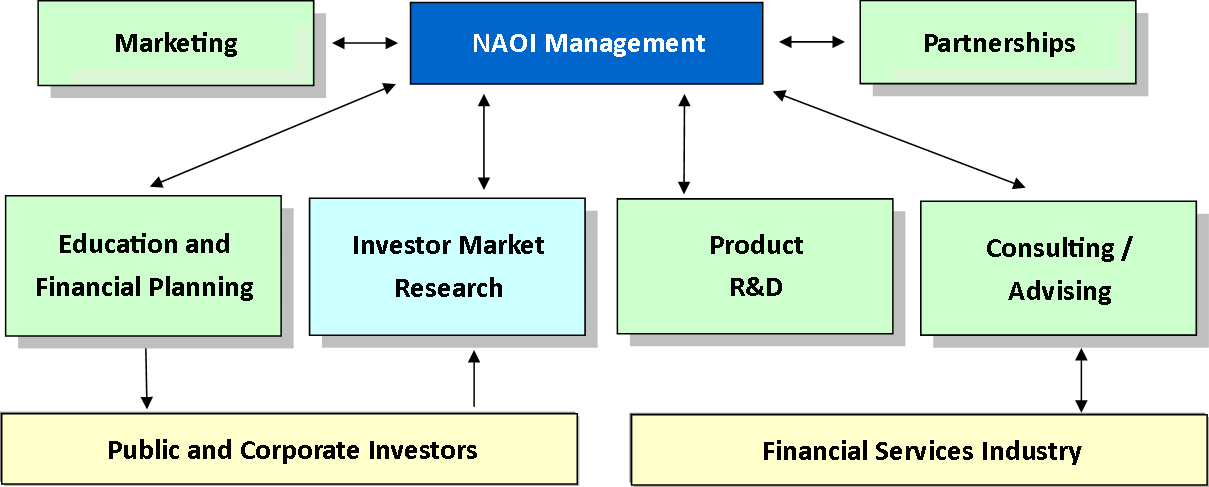

The Growth and Structure of the NAOIThe diagram below shows the current organization chart of the NAOI. It has grown and evolved over the course of the past 20+ years to meet the goals of our current Mission Statement. We have come a long way from offering a simple personal investing course in 1997.

The purpose of each NAOI Division shown above and how they interact to meet our goals are described below. The links included in these descriptions provide a “roadmap” to more detailed information found on other pages of this Web site.

The NAOI Education Division

A major problem with investing today is that nowhere in academia, at any level, have individuals been taught even the basics of this critical life-skill. Therefore, most people see little option but to entrust their financial futures to investment advisors, who are also salespeople, and hope for the best.

The NAOI addresses this problem by offering to the public comprehensive, objective and actionable investing education. The “NAOI Individual Investor Certification Program” is the gold standard for investor education today. For more information related to NAOI education go to this link.

The NAOI Investor-Market Research Division

In the NAOI organization chart, shown above, I have highlighted “Investor Market Research” with a different colored box. Why? Because this activity separates us from other organizations claiming to educate and empower investors.

While we teach the investing public, they also teach us. The purpose of this NAOI Division is to learn from our students who represent a broad cross-section of the investing public. By doing so we have gained an unmatched understanding of their views, opinions, hopes and fears related to the field of investing. We also know how individuals choose financial advisors/organizations to work with, if any, and also the factors they consider when making investing decisions.

This valuable information is used by three NAOI Divisions. It is used by our Education Division to shape NAOI education course content. It is used by our R&D Division to create innovative investment products and investing methods that better meet the needs of the public. And it is used by our Consulting Division to show advisors and financial organizations how to attract more clients by offering products and services that better meet individual investor needs.

The NAOI Financial Planning Center

While the NAOI’s main focus is on empowering individuals to invest with confidence and success, we recognize that Financial Planning is also a critical element of wealth creation.

Based on this understanding, the NAOI has created a Financial Planning Center as a part of our Education Division. In this area we provide students with a set of online, interactive financial planning calculators and worksheets that enable them to document their financial profile, the investing goals they want to achieve in life and the actions they need to take in order to reach them.

NAOI calculators and worksheets can be accessed for free on this site and are also available for licensing and branding by third parties. They can be found in the NAOI Financial Planning Center at this link.

The NAOI Research and Development Division

For over a decade after our founding in 1997 we took for granted that industry-standard investing methods, such as the unquestioned use of Modern Portfolio Theory (MPT) to design and manage portfolios, were optimal for successful investing. The goal of our education content, therefore, was to teach these methods to the investing public. As time passed, however, we found that this thinking was wrong.

Following the market crash of 2008-2009, when the portfolios we had taught our students to create lost significant value, we had to face the harsh reality that buy-and-hold, MPT portfolios, introduced to the market in the 1950’s, simply could not cope with 21st century markets.

With this realization I opened the NAOI Research and Development Division to create innovative investing methods and investment types that better enable individuals to take advantage of the wealth creation potential of modern markets. It became clear to us that more then education was needed to empower investors; also needed was innovation - one example of which is briefly discussed just below.

The Development of Dynamic Investment Theory and Dynamic Investments

The initial project of the NAOI R&D Division was to find an alternative to, or supplement for, the use of MPT methods for portfolio design and management; one that could thrive in today’s volatile markets.

Following a multi-year R&D project, using extensive input from our students, we met this goal in the form of Dynamic Investment Theory (DIT) and a powerful new investment type that DIT creates called NAOI Dynamic Investments (DIs). DIs are “market sensitive” and capable of producing significantly higher returns in all economic conditions than static MPT portfolios with lower risk and no active management required. We are currently in the process of adding this new investment type to our education content and, as a result, demand that financial organizations offer it will grow fast.

More information related to DIT and DIs is found starting at this link. The “Introducing Dynamic Investment Theory” book (pictured nearby) provides more details on this new approach and can be purchased in the NAOI Store found at this link. Readers of this book will be able to take full advantage of powerful Dynamic Investments and Dynamic Portfolios immediately after finishing the last chapter.

The NAOI Consulting Division

The NAOI Consulting Division was created to share our education content, market research data and new investing developments with the financial services industry.

Via an NAOI Consulting Agreement we show both investment advisors and financial organizations how to gain a massive competitive advantage in a very crowded field by offering more effective investing methods and higher-performing products to both individual and institutional investors. For more information related to NAOI Consulting go to this link.

NAOI Partnerships and Advisory Agreements

The NAOI offers Partnerships to financial organizations that share our passion for empowering individuals to invest with confidence and success.

Based on 20+ years of working with the investing public we have gained a sterling reputation as a strong advocate for the individual investor. A Partnership with us will elevate any organization’s “trust-factor” with the investing public. This is a significant competitive advantage in a field where a recent CFA Institute survey (found at this link) showed that only 23% of individual investors trust their financial advisor.

More information related to NAOI Partnerships is found at this link.

Advisory Agreements

NAOI President Leland Hevner is available to join company Advisory Boards to ensure that the voice of the individual investor is heard and taken into consideration in a financial organization’s strategic planning process. Hevner’s CV is found at this link.

To World of Investing Must Evolve

Input from NAOI students tells us that the way investing works today has a short life-span. 1950’s-era MPT, buy-and-hold portfolios are simply too risky to own in modern volatile markets. As a result we are seeing a significant number of people leaving the market or investing far too conservatively and not taking full advantage of the wealth generation potential of modern markets. To survive and thrive, the world of investing must evolve to better meet the the needs of investors in 21st century markets.

The NAOI has taken a first step toward meeting this goal with the development of Dynamic Investment Theory and Dynamic Investments mentioned above on this page. By providing higher returns, lower risk and absolute protection from market crashes, NAOI focus groups who are field-testing DIs in their portfolios tell us that this is the approach to investing that will enable them to finally enter the market with confidence and without fear. They also tell us that they will actively search for financial advisors and organizations that offer it.

But DIT and DIs are simply one element of a more comprehensive evolution of investing. The NAOI is developing other innovative investing solutions that will usher in a simpler, more user-friendly, more profitable and less risky future of investing. We invite organizations to join us in this effort via a Strategic and/or Development Partnership as discussed at this link.

Let’s Talk

Feel free to contact me directly at LHevner@naoi.org, or on LinkedIn to discuss how we can work together to change the world of investing to better meet the needs of both buyers and sellers of investment products and services.

“The Future of Investing Starts Here” is a registered trademark of Leland Hevner and the NAOI.