The National Association of Online Investors (NAOI)

The Market’s Leading Provider of

Investor Education, Investment Innovation and Financial Consulting

Welcome to the Web site of the National Association of Online Investors (NAOI). Founded in 1997, the NAOI is a unique financial organization that works with both investment buyers and investment sellers to better meet the goals of each. We do so by providing the following elements of successful investing.

1. Investor Education. The NAOI is the market’s premier provider of objective, comprehensive and actionable investor education. Thousands of individuals have taken our online courses, read our books or attended our college classes.

2. Investment Research and Development. The NAOI is a leading developer of innovative investment types and investing methods that enable individuals to enter the market with confidence, with success and without fear.

Scroll down on this page to get a “first look” at an innovative investment vehicle designed by the

NAOI R&D called Dynamic Investments (DIs). They are changing how investing today works at a fundamental level.

3. Financial Consulting. The NAOI works with financial organizations to show them how to design and market investor solutions that we know will enable them to attract far more clients than they do today.

This Web site shows how these three investor-empowerment elements work together to make the world of investing simpler, more profitable and less risky for both the investing public and the financial services industry. Click this link to learn how the NAOI is uniquely organized to meet this goal.

Why Today’s Investing Methods Must Change

Hello. My name Leland Hevner. I am the President and CEO of the National Association of Online Investors (NAOI) an organization I founded in 1997 with the goal of enabling individuals to invest with confidence, with success and without fear.

As we teach our students, they teach us and we know that far too many individuals who need investing income are leaving, or not entering, the market. Why? They are increasingly reluctant to accept the buy-and-hold portfolios they are offered by advisors today. They see the risk of significant losses when markets correct or crash as being simply too high. Many are buying annuities instead and, by doing so, are not taking advantage of the higher returns potential of investing in equities.

At the root of this problem is the universal use of Modern Portfolio Theory (MPT) to design and manage these portfolios. MPT was introduced in the 1950s when market were a far different place. While markets have changed, MPT methods have not and they no longer work in modern markets.

Click here to see why investors are reluctant to hold MPT portfolios today.

Introducing Dynamic Investing Theory (DIT) - An MPT Alternative

To address the problems related to MPT portfolios today the NAOI Research and Development team has developed a new theory of investing called Dynamic Investment Theory (DIT).

MPT dictates that portfolios be designed to match the risk profile of each investor and then they are to be held for the long-term. In contrast, the goal of DIT portfolios is to maximize returns and minimize risk in all market conditions. To do so it uses the predictive power of market price trends, the unique features of Exchange Traded Funds and absolute protection from significant losses provided by Trailing Stop Loss orders.

Using a completely different approach than MPT, DIT designs portfolios that are market-sensitive and capable of producing returns that are consistently and significantly higher than virtually any ETF, mutual fund or MPT portfolio being offered today. And they do so with lower risk. MPT says this is impossible. DIT proves this assertion to be wrong.

By having the goal of maximizing returns and minimizing risk, DIT-based investments work for all investors regardless of their risk profile. They also use objective observations of market movements to automatically signal trades and by doing so eliminating trades based on human emotions, bad data and outright fraud.

Introducing Dynamic Investments (DIs)

DIT sets the logic and rules for the creation of an innovative investment type called Dynamic Investments (DIs), each of which has the following components, that value of each is defined by the DI designer to meet a full range of investing goals:

1. DEP

2. Price Trends Indicator

3. Review Period

4. TSL Trigger %These components enable DIs to automatically detect areas of the market trending up in price and purchase ETFs that track them while automatically avoiding, or quickly selling, ETFs that track areas of the market trending down.

The Amazing Performance of Dynamic Investments - An Example

The NAOI Core DI vs. Today’s Default 60/40 Portfolio

The NAOI Alpha DI

The NAOI Leveraged DI

The NAOI Research Report that Ushers In the Future of Investing

A Seminal research report by the NAOI that ushers in a simpler, safer and more profitable world of investing for both buyers and sellers.

Dynamic Investment Theory (DIT) and Dynamic Investments (DIs) are explained in detail in the 64-page Research Report shown nearby. Readers of this Report will be able to easily design DIs and Dynamic Portfolios for a full range of investing goals. And those that take action based on what they learn here will attract far more clients than they do today.

The NAOI is currently teaching the design and use of DIs throughout our extensive educational network. Students tell us that this is the investment type that gives investors the higher returns they want with the protections from loss they need. And they will search for advisors that offer them.

The Table of Contents of this Report can be found by clicking this link. The Report can be purchased is found at this link.

Before doing so, however, you will want to look at the performance of several DIs designed by the NAOI presented just below. You will be amazed.

Put this at another Link

At the root of the problems and fears faced by individual investors today is the universal use of Modern Portfolio Theory (MPT) to design and manage portfolios. Introduced to the market in the 1950’s, MPT dictates that portfolios be designed to match the risk profile of each investor. Then they are to be held for the long-term with no sensitivity to changing market conditions.

While markets have evolved significantly over the past 75+ years, MPT has barely changed at all and the portfolios this methodology creates are not optimal in today’s dynamic markets. Here are a just two reasons why:

1. A Rapidly Changing Portfolio Goal. MPT portfolios are initially designed to match the risk profile of each investor. This is done by allocating money mainly between stocks and bonds. But almost immediately after an MPT portfolio is created the prices of stocks and bonds begin to change and with them the portfolio’s risk profile. As a result, what started as a conservative portfolio can quickly become one that is very risky.

2. Holding Losing Investments At All Times. MPT portfolios reduce risk by purposely holding both winning and losing investments, typically in the form of uncorrelated assets such as stocks and bonds. While this strategy does reduce risk it also reduces returns. Students tell us that average annual returns of between 7% and 10% are not worth the very real risk of losses exceeding 15%, 20% and higher when markets correct or crash. And history shows that these losses can take years to recover.

There are many other problems with owning MPT-based portfolios in modern markets. Just a few are listed at this link. They are examined in more detail in an NAOI Research Report entitled “The Power of ETF Combinations” that is discussed below on this page.

Introducing Dynamic Investments - This Is the Future of Investing

the future of investing is here in the form of dynamic investments

To address the problems related to MPT portfolios today the NAOI Research and Development team has designed and developed a simple but powerful new investment type called Dynamic Investments (DIs).

DIs are unlike any investment vehicle in use today. They use the predictive power of market price trends, the unique features of Exchange Traded Funds (ETFs) and the protective power of Trailing Stop Loss orders to give investors the returns they want with the protection from losses that they need.

The Dynamic Investment Components

Below is a diagram of the components of all Dynamic Investments followed by a brief description of each.

1. The Dynamic Investment Pool (DEP) - DIs are designed to work with combinations of uncorrelated, or low correlated, ETFs defined by the designer. These are the DI’s “purchase candidates”. The DI holds only ONE of these ETFs at a time using the DI components explained below.

2. The DEP Review Period - On a periodic basis (e.g. monthly or quarterly at the designer’s discretion) DIs review the price trends of each ETF in the DEP and purchase, or retain if already held, the one ETF having the strongest price uptrend. The DI holds this ETF until the next Review Event when the review process is repeated.

3. The Price Trend Indicator- This is the indicator used to identify the ETF in the DEP having the strongest price uptrend. An example is the percent return since the previous Review Event. This component makes DIs “market sensitive”, enabling them to produce higher returns with lower risk than virtually any investment type being offered today.

4. The Trailing Stop Loss Order - A Trailing Stop Loss (TSL) order is placed on the ETF purchased by the DI giving it absolute protection from significant losses during the short period of time it is held between Review Events.

These components give DIs a built-in trading system that makes trades based on objective observations of market data as opposed to subjective decisions used by MPT portfolios. By doing so a massive human-risk element is eliminated from the use of DIs. And the DI trading system is easily automated.

An unlimited number of powerful DIs for a full range of investing goals can be created by changing the values of these components. The NAOI shows both our students and professionals how to do so in the NAOI Research Report shown just below.

The NAOI Dynamic Investment Research Report

Dynamic Investment Theory (DIT) and Dynamic Investments (DIs) are explained in detail in the 64-page Research Report shown above. Readers of this Report will be able to easily design DIs and Dynamic Portfolios for a full range of investing goals. And those that take action based on what they learn here will attract far more clients than they do today.

The NAOI is currently teaching the design and use of DIs throughout our extensive educational network. Students tell us that this is the investment type that gives investors the higher returns they want with the protections from loss they need. And they will search for advisors that offer them.

The Table of Contents of this Report can be found by clicking this link. The Report can be purchased is found at this link.

Before doing so, however, you will want to look at the performance of several DIs designed by the NAOI presented just below. You will be amazed.

The Power of NAOI-Designed DIs

Below are shown the performance of three Dynamic Investments designed by the NAOI for the backtest period of 2008 to 2023. You can see that the returns that they are capable of producing far exceed the returns of virtually any ETF, Mutual Fund or even MPT portfolio being offered by advisors today.

These DIs example were designed and tested by the NAOI using our backtesting platform to define their variables. An unlimited number of DIs can be designed to meet a wide ranges of investing goals. The process for doing so in explained in the NAOI Research Report discussed just above.

The NAOI “Core DI” Performance vs. 60/40 MPT Portfolio Performance: 2003-2008

The chart below illustrates the power of DIs. It compares the returns of an industry standard 60% Stock / 40% Bond MPT-based portfolio with the simplest possible DI that we call the NAOI Core DI.

The MPT portfolio holds both Stocks and Bonds (i.e. both winning and losing equities) at all times. Why? To reduce risk but it also reduces returns. In contrast the NAOI Core DI is designed to purchase and hold only one Stock OR Bond ETF at any one time depending on which is trending up most strongly in price at a Review Event. (i.e. it strives to hold ONLY the “winning” ETF from the DEP at all times).

This example shows that the Core DPort more than doubled the annual returns of the MPT portfolio for the backtest period shown. And it did so with significantly lower risk. This is possible because DIs use two risk reduction elements that MPT portfolios don’t. These are a Trailing Stop Loss order on the ETF held and a Periodic Review that can change the ETF held if another ETF in the DEP is trending up in price most strongly.

This is a revolutionary change to how an investment type produce higher returns without higher risk. MPT says this is impossible. DIs show that in this area MPT is wrong. The NAOI Research Report shows how and why.

Other DIs -

Alpha - Return - Link

Leveraged - Return - Link

What About Risk?

Diagram and Link

Enabling Dynamic Portfolios

It is not the purpose of the NAOI to eliminate MPT

Just a Few Benefits

For Investors

For Sellers and Developers

Working with the NAOI

The NAOI “Alpha DI” - Move this to a new link

While the Core NAOI DI shown above produces returns that are unheard of in today’s markets, by adding additional, carefully selected and tested ETFs to the DEP, even higher returns are possible and, again, with lower risk. An example of this is a DI designed by the NAOI called “Alpha DI”. This DI differs from the Core DI by holding more and different ETFs in its DEP.

You can see in the above chart that the Alpha DI produced average annual returns during the years from 2008 to 2023 that are impossible in the MPT-based world of investing today. And they do so with lower risk. Note that this is only one example of an unlimited number of high-performance DIs that can be created for a vast range of investing goals. And they are easily designed without the need to create a single new ETF.

The NAOI Leveraged DI

The NAOI has designed and tested a full catalog of high-return, low-risk DIs. At the top end of this list of DIs is one that we call the NAOI “Leveraged” DI that places in its DEP a 3x Bull Market ETF and a Cash Equivalent ETF as shown in the example below. Leveraged ETFs can produce extremely high returns but also extremely high losses. But this is perfect for the DI structure that will purchase only the ETF when it is trending up in price and sell it quickly when it begins to trend down and replaces it with a Cash ETF. The table below describes the components of this remarkable DI and along with its amazing performance.

Returns of this magnitude with low risk are not possible using MPT portfolios. Only NAOI Dynamic Investments enable this type of performance.

Introducing Dynamic Portfolios

DIs can be used as an investor’s total portfolio. By taking advantage of the predictive power of market price trends, DIs produce higher returns with lower risk than virtually any MPT portfolio in existence today.

But it is not the intention of the NAOI to eliminate the use of MPT portfolios, the shock to the entire investing system today would simply be too great. And “buy-and-hold” strategies have their benefits. So we teach our students, and show our consulting clients, how to use DIs as building blocks in an MPT portfolio structure to both enhance their returns and lower their risk.

We call DI-enhanced portfolios “Dynamic Portfolios” or DPorts for short. Just below is an example.

The NAOI “Core Dynamic Portfolio”

Shown below is an example of a simple but powerful investment type that we call the NAOI Core Dynamic Portfolio. The allocations of money to each element in this portfolio is defined by the DPort designer to meet the needs of each investor. However the NAOI has found the the allocations shown below work for all investors regardless of their risk profile.

In this DPort when Stocks are trending up its asset allocations will be 80% Stocks and 20% Bonds. When Stocks are trending down its allocations will be 70% Bonds and 20% Stocks.

The NAOI Core Portfolio is the perfect portfolio for ALL investors regardless of their risk profile. It gives investors higher returns than MPT-only portfolios with absolute protection from significant losses. As such it is the market’s first “portfolio product” that can be sold without customization to every investor. Advisors that offer it will be able to dominate the retirement industry as well as to capture the massive revenue potential of less affluent investors who simply plug and play it.

And remember, allocations to each of the components of a DPort can be automated in response to Stock/Bond price trends. As a result, today’s “rebalancing” problem is solved.

Let’s Talk About Risk

Risk today is measured by the volatility of an equity, an ETF or a portfolio. It is measured by a statistical measure called Standard Deviation that shows how far an investment's return moves above or below its average (mean) return using a Bell Curve. An investment with a high Standard Deviation (i.e a wider Bell Curve) is considered riskier than an investment with a lower Standard Deviation (i.e. a more narrow Bell Curve). This is illustrated in the picture at left, below.

But this industry-standard way of measuring risk only applies to investments that are bought and held for the long-term (i.e. using MPT methods). It does not apply to DIs that stop losses in two ways. DIs automatically sell the ETF it holds if it triggers the TSL give it or if at a periodic Review Event another ETF in its DEP is trending up in price more strongly. Thus, when working with DIs, today’s risk measures don’t apply. DI risk is significantly lower than the risk of buying and holding equities in MPT-based portfolios offered to investors today.

Using a totally different approach to measuring Investment Risk changes the way investing works today at a fundamental level. The NAOI Research Report discussed above devotes a section to showing the implications of this change and why the world of investing is about to become simpler, safer and more profitable than it is today.

DIs Enable Many More Diversification Elements

Another way of lowering risk is via diversification. In the MPT world this mean including in a portfolio different types of equities such as Stocks, Bonds, Commodities, Real Estate, International Equities, etc. When a portfolio holds uncorrelated or low correlated equity types its risk goes down, but so does its returns. And other than stocks and bonds deciding which of these equities to hold is a bit of a guessing game.

DIs enable greater portfolio diversity in a totally different manner as discussed below.

1. A Dynamic Portfolio can be diversified by having both a buy-and-hold (MPT-based) and a buy-and-sell (DI-based) segment.

2. A DPort can hold DIs with the same parameters except for the Review Period - e.g. Monthly and Quarterly. The same applies to the Trailing Stop Loss sell trigger. For example one can be set at 12% and one at 15% with all other variables the same.

Both of these examples add diversity to a DPort and thus lower risk and can also increase performance. Added diversity elements related to DIs and DPorts are discussed in more detail in the NAOI Research Report.

The Benefits of Using DIs For Both Buyers and Sellers

The unique features of DIs enable incredible benefits for both investment buyers and sellers. Below are listed just a few of these benefits. More are discussed in the NAOI Research Report.

For Investment Sellers and Developers:

1. As illustrated above DIs produce higher returns with lower risk than any investment type being offered today. As a result financial organizations and advisors that include them in their product line can attract far more clients than they do today.

2. By monetizing combinations of existing ETFs in the Dynamic Investment format, DIs significantly increase the value of existing product lines without the need to create a single new ETF.

For Investment Buyers:

1. As illustrated above on this page, DIs provide investors with higher returns and lower risk than virtually any investment type being offered to them today.

2. DIs are the only investment type that gives investors absolute protection from significant loses when markets correct or crash.

3. DIs have a built-in trading system that automatically purchases only ETFs moving up in price and avoiding, or quickly selling those that are trending down. DIs use objective observations of market data to make trading decisions and by doing so eliminate a massive “human-risk” element used for this purpose today.

The Benefits of Working with the NAOI

On this page you have learned about a new investment type developed by the NAOI called Dynamic Investments (DIs). You have had just a glimpse at how they work and the benefits they provide to both investment buyers and sellers. And you can see why they will make investing far simpler, safer and more profitable than the investment products being offered by the financial services industry today.

To take full advantage of this new investment type and investing approach investing professionals should first consider reading the NAOI Research Report discussed above and available for purchase at this link.

In this 64 page Report you will learn how to create a full product line of DIs for a wide range of investing goals.

But to take maximum advantage of this DIs you should also consider working with the NAOI as either a consultant (see this link) or as a Partner (see this link). We can give you the tools needed to determine optimal values for each of the DI variable e.g. the ETFs to place in a DEP, and optimal values for the length of the Review Period and the TSL sell-trigger % used.

We can also work with our consulting clients / partners to create include DIs in a marketing program that will give them a massive competitive advantage in today’s crowded market of financial services.

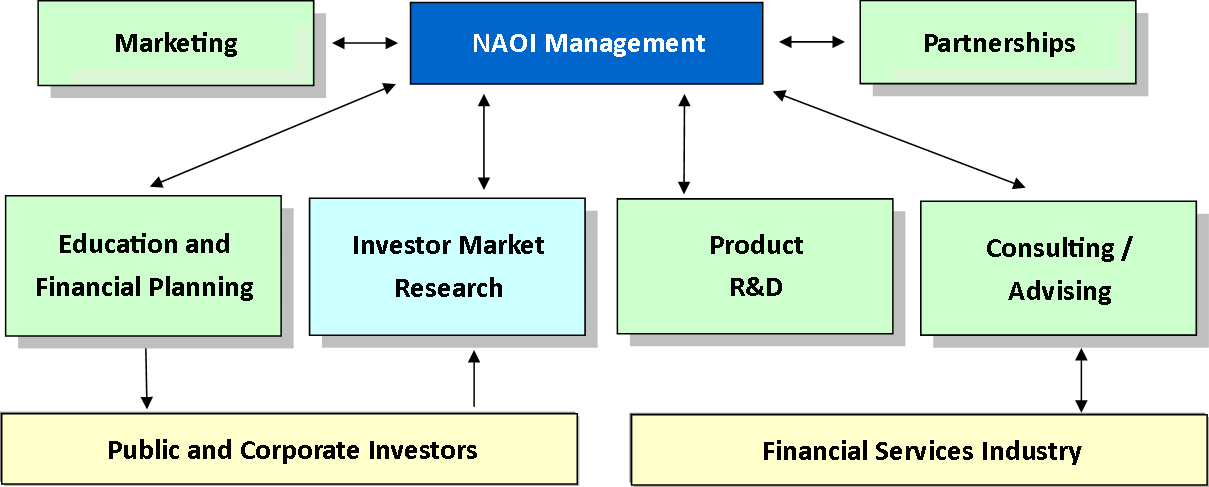

The Organization Chart and the Evolution of the NAOI

Below is the current organization chart of the NAOI. It has grown and evolved over the course of the past 25+ years to provide investors with the knowledge and resources needed to successfully navigate the world of investing. The NAOI has evolved significantly since our initial offering of a single investing course in 1997.

The purpose of each Division shown in the above chart is described below on this page. Links are included in each description to areas of this Web site where more detailed information is found.

The NAOI Divisions

The Education Division provides to individuals the objective, comprehensive and actionable education products that enable them to enter the market with confidence, with success and without fear.

The Investor Market Development Division continuously solicits input from our students and the investing public in general. The NAOI uses this information to continually update and enhance our education courses and to create superior investing products via our Research and Development Department. LINK

The Investment Research and Development Division uses student input to define and create innovative investment types and investing methods that meet the wants and needs of the the public far better than the products offered to them by the financial services industry today. This Division is changing the way investing works at a fundamental level by designing market-sensitive investment types and portfolios.

The Consulting Division uses this information to show investments advisors and financial organizations how to create and offer investing products/services that will give them a significant competitive advantage in the crowded field of financial services. LINK

Change to the Way Investing Works Today Is Needed

As we teach people how to invest, they also teach us. And we know that far too many individuals who need investing income are leaving, or not entering, the market today. Why? Static investment types and portfolios in dynamic markets. The risks of significant losses is simply too high. Many are choosing to buy annuities instead without a thorough knowledge of the risks involved.

The NAOI Research Project

For over a decade the NAOI taught MPT for portfolio design and management. Following the disastrous crash of 2008-2009 and the significant losses incurred by our students the NAOI began a R&D program to find an alternative to, or supplement for, MPT. We told them to think differently about how investing could and should work as if MPT didn’t exist.

User Goals

The R&D project began with input from our students. We asked then what they needed in investing products to participate in the market with confidence and without fear. The following features topped the list:

* Simple to Understand and works with

* Higher returns with lower risk

* Absolute Protection from significant losses

* Objective, not Subjective - quant. automated, effectiveFollowing a multi-year effort the NAOI met all of these goals with a new investing theory called Dynamic Investment Theory and an innovative investment type called Dynamic Investments. Below is just a glimpse at how they work and the performance they enable. More information is found at this LINK.

Success! The Change Needed

Use of market trends to trigger trades

Introducing Dynamic Investments and Portfolios - This is the Future of Investing

Components

Examples

The NAOI Education Division

A major problem with investing today is that nowhere in academia, at any level, are individuals taught how to successfully participate in equity markets. They may be taught how investing works, but they are NOT taught how to navigate this complex field in a manner that increases their wealth and avoids significant losses.

The NAOI addresses this problem by offering to the public comprehensive, objective and actionable investor education. The “NAOI Individual Investor Certification Program” that includes the courses pictured below is the gold-standard for investor education today. For more information related to NAOI education go to this link.

the naoi individual investor CERTIFICATION PROGRAM

While not all individual investors need the level of education provided by the above Certification Program, any advisor or financial organization that offers at least a basic investor education course, customized with the help of the NAOI as offered by our Consulting Division, will hold a massive competitive advantage in the crowded field of financial services. More information on this topic is found at this link.

The Investor-Market Research Division

The purpose of this Division is to listen to and learn from our students who represent a broad cross-section of the investing public. By doing so we have gained an unmatched understanding of how they view the investing world, their expectations and their fears. We also know the factors that they consider when searching for financial advisors and organizations to work with.

This incredibly valuable information is used by three NAOI Divisions. It is used by our Education Division to continually update our education course content. It is used by our R&D Division to create innovative investment products and investing methods that better meet the wants/needs of the public. And it is used by our Consulting Division to show financial advisors how to attract far more clients than they do today.

The NAOI Financial Planning Center

The NAOI’s recognizes that Financial Planning is a critical element of wealth creation. As a result, we have created a Financial Planning Center as a part of our Education Division. In this area we provide students with a set of online, interactive financial planning calculators and worksheets that enable them to document their financial profile, set investing goals and take the actions needed to reach their goals.

These proprietary NAOI calculators and worksheets can be accessed for free on this site and are also available for licensing and branding by third parties. They can be found at this link.

The NAOI is changing how investing works at a fundamental level

The NAOI Research and Development Division

For over a decade after our founding in 1997 we took for granted that the only way to build investment portfolios was via the use of a portfolio design and management methodology called Modern Portfolio Theory (MPT). Introduced to the market in the 1950’s, this approach dictates that portfolios be designed to match the risk tolerance of each investor and then held for the long-term, through all economic conditions. A major goal of our education content, therefore, was to teach MPT methods to our students. As time passed, however, we found that this thinking was wrong.

Following the market crash of 2008-2009, when the MPT portfolios we had taught our students to create lost significant value, we had to face the harsh reality that static, buy-and-hold, MPT portfolios simply could not cope with modern volatile markets.

With this realization we opened the NAOI Research and Development Division to create innovative investing methods and investment types that better enable individuals to take advantage of the wealth creation potential of modern markets. It became clear to us that more then education was needed to empower investors; also needed was innovation. More information is found at this link.

The Introduction of “Dynamic Investment Theory” and “Dynamic Investments”

The most recent development from our R&D Division is the creation of an alternative approach to MPT for designing and managing portfolios called Dynamic Investment Theory (DIT). This theory sets the logic and the rules for the creation an innovative investment type called Dynamic Investments (DIs) that automatically change the ETFs they hold based on a periodic sampling of market price trends.

By being “market-sensitive”, extensive testing shows that DIs are capable of producing significantly higher returns with lower risk than virtually any ETF, Mutual Fund or even MPT portfolio being offered today. And they provide investors with absolute protection from market crashes - a critical element of successful investing.

The NAOI is currently teaching the use of Dynamic Investments in our education courses using the “DI Users-Manual” shown above, at right. NAOI students who have learned about DIT and DIs tell us that this is finally the approach to investing that will enable them, and thousands like them, to enter the market with confidence and without fear. You can learn more about the DIT investing approach starting at this link. And the User’s Manual can be purchased in the NAOI Store.

The NAOI Consulting Division

The NAOI Consulting Division was created to share our education content, investor research data and innovative investing products/methods with the financial services industry.

Via an NAOI Consulting Agreement we show financial professionals how to create and offer investing products and methods that better meet the needs of the investing public than those being offered today. By doing so, our consulting clients are able to significantly expand their client base, increase revenues and gain a massive competitive advantage in a very crowded field. For more information related to NAOI Consulting go to this link.

The NAOI has also created a Research Report entitled “The Power of ETF Combinations” that is pictured nearby. It shows how DIT and DIs work and how advisors and financial organizations can use this new portfolio design and management approach to create superior products and attract far more clients than they do today.

We are currently making pre-release access to this seminal Research Report available to a select group of financial professionals and financial organizations that we believe will benefit most from learning about this 21st Century approach to investing first. To be considered for pre-release access to the Research Report go to this link.

NAOI Partnerships

The NAOI offers Partnerships to financial organizations that share our passion for empowering individuals to invest with confidence, success and without fear.

Based on 25+ years of working with the investing public we have gained a sterling reputation as a strong advocate for the individual investor. A Partnership with the NAOI will elevate any organization’s “trust-factor” with the investing public. This is a significant competitive advantage in a field where a recent CFA Institute survey showed that only 23% of individual investors completely trust their financial advisor.

We offer Research and Development Partnerships that enable organizations to work with the NAOI to create new products in conjunction with our development team.

More information related to NAOI Partnerships is found at this link.

NAOI Advisory Assistance

NAOI President Leland Hevner is available to join financial organization Advisory Boards. In this role he draws on his 25+ years of working with the investing public to show organizations how to create marketing plans, investing products and investor solutions that will give them a significant advantage over their competitors. Hevner’s CV is found at this link.

True Investing Evolution

Many organizations today are attempting to “evolve” the world of investing to meet the challenges of modern markets via a variety of fintech methods. And the NAOI sees much value in these efforts. But our experience in working with the investing public tells us that average investors have little interest in them.

The NAOI believes that true investing evolution comes only from questioning and continuously updating how investing works to enable investors to profit in changing markets. This means challenging the use of Modern Portfolio Theory (MPT) as the only way to design and manage investment portfolios. The NAOI is doing so with the introduction of Dynamic Investment Theory (DIT) as discussed beginning at this link.

Financial Organizations and Investment Advisors - Let’s Talk

There is absolutely no simpler, quicker or more cost effective way for a financial organization to gain a massive competitive advantage in the crowded field of investing services than by working with the NAOI. We know what the public wants/needs to participate in the market with confidence and without fear. As leaders in the world of investing education we are well positioned to make our students aware of the financial advisors that offer the innovative investing products and methods created by the NAOI.

Feel free to contact NAOI President, Leland Hevner directly at LHevner@naoi.org, or on LinkedIn to learn more about how we can work together to enable your organization to attract far more clients than you do today.

“The Future of Investing Starts Here” is a registered trademark of Leland Hevner and the NAOI.