A single Dynamic Investment can be the ONLY investment you hold. It is fully company-diversified by the use of ETFs and it is asset-diversified by holding ETFs for multiple assets in its Dynamic ETF Pool (DEP). And it is also “time-diversified” by being capable of changing the ETF it holds based on a periodic observation of market trends.

You saw on this page the superior performance of just holding a simple DI with a Stock and Bond ETF in its DEP for the period from 2007 to 2018. Who would not have wanted to hold this investment during this turbulent period when the value of static, MPT portfolios was experiencing significant fluctuations in value.

But the NAOI knows that allocating 100% a portfolio’s money to one ETF at a time can be too much of a "culture shock” for most investors. Most NAOI students prefer to include DIs in a more traditional portfolio structure. And this is easily done by treating DIs a building blocks for Dynamic Portfolios.

DI Portfolio Building Block Types

The NAOI has defined four DI "types" that can be used as Dynamic Portfolio Building Blocks. DI types are determined by the ETFs that are included in their DEPs as discussed below with examples:

Type 1: Multi-Asset DIs

This type of DI contains ETFs in its Dynamic ETF Pool (DEP) for different asset classes. Thus, it rotates between or among owning the major assets based on which is trending up most strongly as the time of a Review. The asset classes used will be mainly Stocks and Bonds but could also include Real Estate, Commodities, Emerging Markets, etc. Below is an example of the ETFs that a Multi-Asset DEP might hold. This is followed by a table that shows the 2008-2017, inclusive, performance of an MPT portfolio and a Dynamic Investment working with the same ETFs. The following diagram shows at left a sample DEP for this DI type and then, at right, a performance comparison between a traditional MPT portfolio with the allocations shown and an example Multi-Asset Class DI.

Example DEP for a Multi-Asset DI:

Holding 60% RZG and 40% EDV, rebalanced quarterly for the period would have earned an average annual return of 12.1% with a Sharpe Ratio of 0.82.

Asset Focused DIs. This type of DI holds ETFs in its DEP that are primarily focused on one asset class - Stocks in this example. In today's MPT-based world a portfolio designer who wants to add to the portfolio exposure to stocks, they must then decide which types of stocks to include. There are many choices such as large-cap, medium-cap, small-cap and then growth or value for each market cap. Most designers simply include a Total Stock Market ETF or mutual fund and move on. By doing so they can leave a lot of positive returns on the table as different stock types can perform much better than the total stock market. The problem is solved using a Dynamic Stock Investment. This DI contains ETFs for multiple stock types in its DEP. Then, during a Review event, the ETFs in the DEP are ranked and only the one ETF that is trending up most strongly is bought and held until the next Review when the DEP is ranked again. Thus, the MARKET selects the type of stock to own and by being able to switch between stock types enables this DI to produce significantly higher returns than a Total Stock Market ETF. Also note that the DI has an "Escape Valve" ETF that is a Bond ETF. This is purchased if the entire stock market is trending down, in which case history tells us that Bonds should be trending up. The diagram below shows the astounding difference in performance provided by the Dynamic Investment.

Market Focused DIs. The type of DI is used when a portfolio designer or investor wants exposure to a specific area of the market for example the Internet. These types of investments can be very risky in an MPT portfolio where they are bought and held for the long-term. This problem is solved by including an Internet Focused DI that contains the ETFs shown in the DEP below. Here the Internet ETF will only be purchased and held for one period if it is trending up in price more strongly than either Stocks or Bonds. In the below example the Internet ETF, PNQI, was held for about one third of the time during the backtest period. All other times it held either a Stock or a Bond ETF. You can see from the performance table that the Dynamic Internet DI was far more profitable and less risky than simply buying and holding the Internet ETF, PNQI.

Simply buying and holding PNQI for the period would have produced an 18.7% Average Annual Growth Rate with a Sharpe Ratio of 0.75.

Mixed Focus DIs. The final DI type that I will discuss is one having a DEP that holds ETFs for at least two assets class - for example Stocks and Bonds. And for at least one of these asset classes it holds ETFs for multiple "types" of the asset - as an example, for the Stock asset class it may hold an ETF for Large-Cap Value Stocks and an ETF for Small-Cap Growth Stocks. For the Bond asset class it may hold two Bond types such as Long-Term Government Bonds and Junk Bonds. The NAOI Primary DI is an example of a Mixed Focus DI having the following DEP and Performance Data.

Dynamic Portfolios (DIs Only)

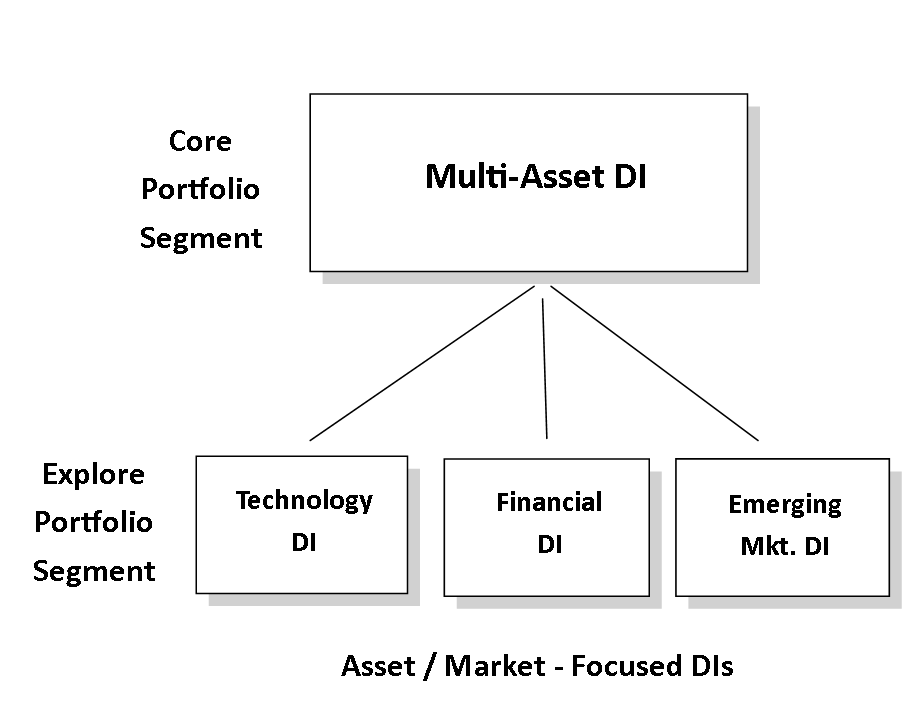

The diagram below shows how a Dynamic Portfolio can be constructed using Dynamic Investment Building blocks in a traditional “Core and Explore” design model.

This portfolio can hold up to four ETFs at one time and thus be more acceptable to investors who are accustomed to holding multi-equity, MPT portfolios. But keep in mind the differences. Each of these dynamic building blocks will strive to hold only ETFs that are uptrending at the time of purchase and they avoid ETFs that are trending down. Plus, each ETF held is protected against significant losses while owned by a Trailing Stop Loss Order. This enables far higher performance than MPT portfolios that are designed to hold both winning and losing equities at all times.

MPT / DIT Hybrid Portfolios

The NAOI understands that the switch from MPT portfolios to DI-based portfolios will not happen overnight. For this reason, we have developed a strategy that enables the gradual transition from static MPT portfolios to dynamic DI portfolios. This is done by simply including one or more Dynamic Investments in a traditional MPT, asset-allocation portfolio as illustrated in the diagram below.

When Stocks are trending up this portfolio will have a 75% allocation to Stocks and a 25% allocation to Bonds. When Bonds are trending up the allocations will be 75% Bonds, 25% Stocks. The change is signaled automatically without human subjective decisions involved.

In this configuration the DI would act as both a returns enhancer and a risk reducer for the portfolio. The higher the allocation to the DI segment, the better will be the performance of this Hybrid Portfolio that can easily be implemented today with NAOI training. On the following page I will show how an NAOI Hybrid Portfolio makes the perfect 401(k) default investment.

A Superior 401(k) Default Investment >

"the future of investing starts here" is a registered service mark of the National association of online investors