Introducing Market-Biased Portfolios

As the market’s premier investor education organization, my organization, the NAOI, spends significant time surveying the investing public to learn about the problems they face in the financial world. This input guides our research related to the development of better investing tools and methods.

As a part of this effort the NAOI interviewed and worked with dozens of individuals who were enrolled in 401(k) Plans provided by their employers. We wanted to know the good, the bad and the ugly of their experience with these plans. And we got an ear-full.

Following are just a few of the problems that individuals participating in 401(k) Plans tell us they face. These are the problems the NAOI targeted when designing the Dynamic Investment 401(k) Plan Solution discussed in this chapter.

Substandard Education – Many 401(k) participants have very little knowledge of how to invest and are dependent on education offered by their Plan providers. Many Plan participants find that this education does not come close to enabling them to make effective investing decisions. So most simply accept recommendations given to them by advisors without question. And by doing so they don’t take maximum advantage of this benefit.

Low Portfolio Returns with High Risk – Most Plan participants are advised to purchase portfolios with allocations of money to bonds and stocks that fit their risk profiles. Such allocations are too often determined only by their age and time to retirement; e.g. the closer to retirement the higher the allocation to bonds is a general rule. As you have learned previously in this book, however, there are market conditions in which bonds can be more risky than stocks. As a result, Plan participants often hold portfolios that produce low returns with high risk and are burdened with excessive fees.

High Expenses, Low Value – NAOI students tell us that they don’t understand why they are forced to pay the high expenses and management fees levied by their Plan providers for the quality of education and advice they are given. They see no link between the high expenses they pay and the value they receive from mysterious “fund managers.”

Distrust of Financial Salespeople – NAOI surveys show that the investing public, in general, is skeptical of recommendations made to them by Plan advisors who are also salespeople. They see a major conflict of interest here and wonder if they are being given the best advice possible as opposed to advice that results in the highest compensation for advisors.

Fear of Losing Money – NAOI interviews with individuals who suffered through the market crash of 2008 told us that they are afraid that it will happen again. Our research found that the fear of losing money is far more powerful than the potential of making more money. As a result many employers are finding it difficult to convince employees to enroll in their 401(k) Plans.

The bottom line is that because of these issues and others, far too many employees are not taking full advantage of the 401(k) Plans they are offered. The 401(k) Plan Provider industry needs to step up its game and start offering better products and services. And corporate HR departments need to start demanding more value from these providers.

Fortunately, dramatically improving 401(k) Plans is not difficult. The solution lies in the use of NAOI Dynamic Investments and Market-Biased Dynamic Portfolios that are the focus of this chapter.

Benefits

Simplicity - Dynamic Investments have the universal goal of capturing positive returns that the market offers and avoiding losses. This is a universal goal that works for all investors. Thus, there is no need to customize a DI for any investor. DIs can simply be purchased "off-the-shelf" and held for the long term while the DI automatically signals trades as needed. Thus, DIs eliminate the need for extensive education on such things as risk tolerance, asset allocation, economic analysis, etc. The NAOI supplies the simple education needed to effectively use DIs.

Higher Returns with Less Risk - Dynamic Investments are sensitive to market movements; traditional MPT portfolios are not. DIs automatically sample market trends on a periodic basis in an effort to hold only ETFs that are trending up in price and to avoid or sell those that are trending down. This enables them to capture positive returns where ever and whenever they exist in the market while avoiding losses. MPT portfolios move up and down at the whims of the market.

Absolute Protection from Market Crashes - DIs will automatically sell the ETF owned if its price starts to deteriorate significantly, thus avoiding market crashes like we saw in 2008. Then, when the stock market starts to recover, it automatically buys back in. Eliminating the threat of portfolio crashes will give employees the confidence to participate in their 401(k) Plans without fear.

Automated, Objective Portfolio Management - Investors do not need to be concerned with the ongoing management of the DI or DIs that they own. DIs have the internal intelligence required to detect market trends and signal trades to either capture the positive returns in current markets or to avoid losses. This is done automatically, based on objective observations of market trends and without the need for human judgments. In contrast, traditional MPT portfolios provide no guidance on when to change the equities they hold. MPT portfolio management is totally at the mercy of human judgments which inject a massive risk element into the investing process. This is risk that DIs avoid.

DIs are Portfolio "Products" - DIs are what the financial world has been seeking for decades - portfolio "products". Each DI is created by an NAOI-trained DI Designer and once created the design does not change, although the ETF held does. As a result, DIs can be sold by a variety of vendors via DI "Catalogs" and bought "off-the-shelf" by investors without the need for customization. The investor simply buys and holds a DI for the long-term as it automatically signals trades to either capture gains or avoid losses. When the world of investing is "productized" everything changes for the better!

These factors and others make Dynamic Investments a superior choice over traditional, asset-allocation portfolios in retirement plans of all types. DIs will soon become the standard investment type for all 401(k) Plans. The sooner a 401(k) provider learns about Dynamic Investments, the greater will be their competitive advantage in the future of investing.

Market Biased Portfolios - A Superior 401(k) Default Investment

Market-Biased Portfolios are the perfect default investment product for a 401(k) Plan or any other type of retirement plan. They are incredibly simple to understand, implement and manage. And they provide higher returns with less risk over the long term than virtually any MPT portfolio or Target-Date ETF/fund in existence today. There are many configurations for a Market-Biased Portfolio. Let's look at the simplest one to illustrate the power of this new investment product.

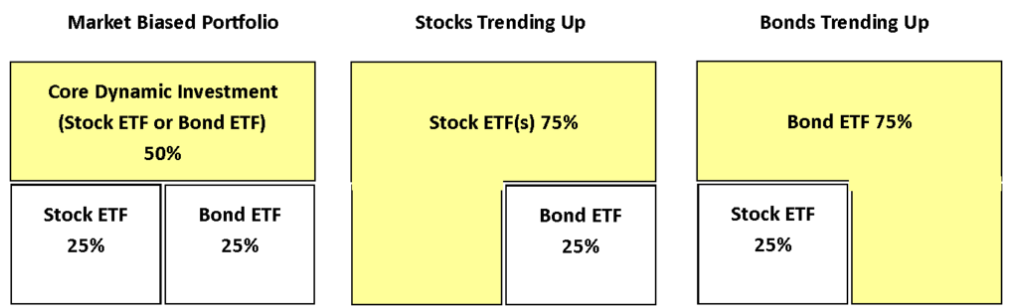

The NAOI "Basic" Market-Biased Portfolio is as simple as it gets. It holds two static investments with equal allocations: e.g. 25% allocation to a Stock ETF and 25% allocation to a Bond ETF. These ETFs are simply bought and held. The third portfolio element is the NAOI Core Dynamic Investment (discussed above) that automatically and periodically rotates between a Stock ETF and a Bond ETF based on price trends.

Thus a Market-Biased Portfolio will hold an allocation of 75% Stocks / 25% Bonds when the stock market is trending up, and 75% Bonds / 25% Stocks when the stock market is moving down. And no subjective human judgment is involved in making these trade decisions - all changes are made based on objective observation of market trends. Below is this concept is presented in diagram format.

Performance Table: 2008-2017

The table below shows the performance of three investment types using the same ETFs, one that tracks Stocks and one that tracks Bonds.

You can see that the Market Biased Portfolio has performance that is between that of the Core DI and a traditional MPT portfolio but will at all times hold both a Stock and a Bond component as shown in the diagram above. This makes holders more comfortable than allocating 100% of their money to one ETF as is the case with the Dynamic Investment.

A Windfall for ETF Developers >

"the future of investing starts here" is a registered service mark of the National association of online investors