Needed: A 21st Century Theory of Investing

the world of investing has just evolved

From the founding of the NAOI in 1997 the NAOI has taught our students how to create portfolios using industry standard Modern Portfolio Theory (MPT) methods. Yet, in 2008-2009 when the stock market crashed, we watched in dismay as these portfolios crashed along with the market. In 2010 when the crash was finally over, I, Leland Hevner, President of the NAOI, made the difficult decision to pause all NAOI education classes.

I had to face the harsh reality that MPT portfolio design methods (introduced to the market in the 1950’s) simply could not cope with modern markets. They produce “static”, buy-and-hold portfolios to deal with today’s “dynamic” markets and they simply can’t cope. MPT-based portfolios neither enable investors to take full advantage of market price uptrends nor protect them from significant price downtrends.

With this realization I refocused NAOI resources from Education to Research and Development in order to find and develop a new approach to portfolio design and investing in general that could take maximum advantage of modern dynamic markets. On this page I provide a brief description of how, following a multi-year effort, we found it this superior approach the form of Dynamic Investment Theory (DIT).

The Goals for a New Approach to Investing

As we started our research effort in 2010, I was determined to find a new approach to investing that was designed to meet the needs of the investing public. So our first task was to interview average people with money to invest. Fortunately the NAOI has access to hundreds of individual investors who are either NAOI students or NAOI members. They represent the comprehensive cross-section of the investing public needed to define our development goals. We asked them what they wanted and needed to become confident investors and willing to enter the equity markets without fear. In summary, they told us that the following features of a new approach were essential:

A greatly simplified approach to investing - one that could be explained in less than 10 minutes

Higher returns with less risk than the MPT portfolios in all market conditions

Absolute protection from market crashes

Reduce the human-risk element in the investing process with a trading plan that signals trades based on objective observations or market data, not based on subjective human judgments

We immediately saw that MPT met none of these goals. So we started our research with a blank slate; as if MPT had never existed.

The Use of Data Analysis and Scientific Methods

From the start it was obvious that the only way to meet these goals was to develop an investing approach in which trade decisions are made based on observations and analysis of historical market data instead of being based on subjective human judgments which are the source of so much that is wrong investing today. To meet the goals set for us by the investing public, we needed an approach to investing based on objective observations of market data and scientific methods.

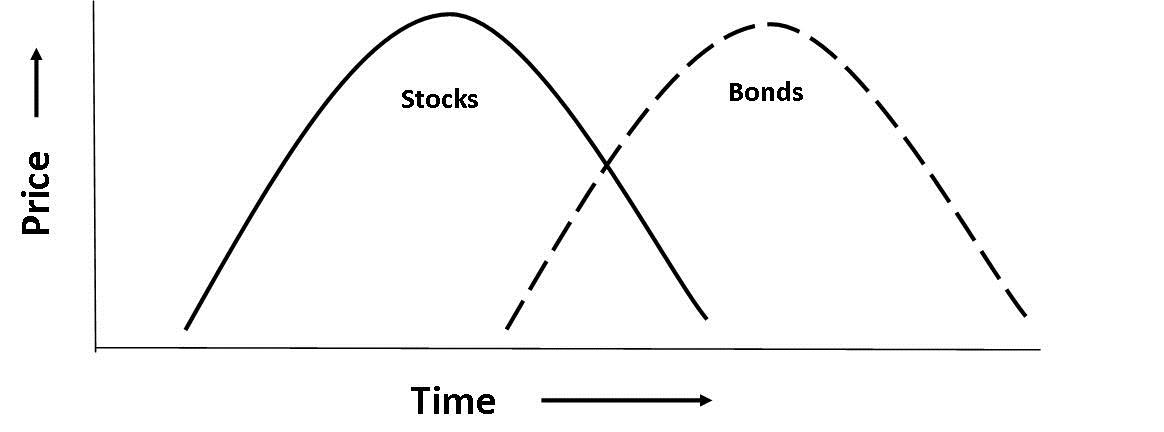

We began our research by looking for patterns in historical data that had proven predictive value for future equity price movements. Based on significant research we found the patterns we needed in the form of equity price trends. Historical data analysis showed to us that the prices of asset classes and markets / market segments are cyclical and that the prices of different asset types and different market segments move up and down at different times as illustrated below.

the cyclical nature of asset pricing

Based on this observation and in keeping with scientific methods we developed the Premise described below.

“At all times and in any economic conditions there exist areas of the market that are trending up in price. It is possible to create an investment type that is capable of automatically detecting these areas and capturing their positive returns potential while avoiding areas of the market that are trending down in price.”

The Creation of a Theory

Continuing with our scientific methodology, the next task was to test our Premise. For this purpose we created and tested dozens of prototype investment designs. We found one design that showed our premise to have a high probability of being true. We called this new investment type NAOI Dynamic Investments (DIs). They are discussed at this link.

Based on positive testing results, we transformed our Premise to a Theory. We called this theory Dynamic Investment Theory (DIT). It sets the logic and defines the rules for creating Dynamic Investments that meet every goal for us by the public, as listed above, and more. With the discovery and development of DIT and DIs, the world of investing changed at a fundamental level; and for the better.

Dynamic Investment Theory

Here is the full version of Dynamic Investment Theory:

“At all times, in any economic environment, there exist in equity markets areas of uptrending prices. And equities that have moved up in price for a significant time in the past have a high probability of continuing to move up in price for at least a relatively short time period in the future.

A simple, dynamic and internally-intelligent investment type, hereafter referred to as a ‘Dynamic Investment’ (DI), can be created that is capable of automatically finding equities trending up in price and capturing their positive returns potential while also detecting equities moving down in price and avoiding their loss potential. And these actions will be based on observations of historical equity price data with no subjective, human-decisions involved.

It is projected with a high degree of confidence that a Dynamic Investment so designed will be able to produce returns that are consistently and significantly higher than those of virtually any MPT-based portfolio, over the same time period, and with lower risk. It is further projected that Dynamic Investments can be designed that are so simple to understand, implement and manage that individuals of all investing experience levels will be able to take full advantage a DI’s higher performance with minimal education and training required.”

The Creation of Value

Below is a simple and quick example of how the use of Dynamic Investments will change the way we invest at a fundamental level. The diagram below shows how using DIT methods, Dynamic Investments create value.

Value Creation of an MPT Portfolio

Immediately below is an example of the performance of a generic MPT portfolio holding just two Exchange Traded Funds (ETFs); one that tracks the Total Stock Market and one that tracks the Total Bond Market. This portfolio holds both ETFs at all times with the allocations shown. The average annual returns for the test period are then shown along with the Sharpe Ratio, a measure of how much return is received for each unit of risk taken - and the higher the better..

Value Creation of a Simple Dynamic Investment

The below diagram shows the performance of the simplest possible Dynamic Investment, using the same ETFs as the above MPT portfolio but only owning one at a time with a 100% allocation. The ETF owned is the one that has trended up most strongly in price at a quarterly review.

You can see that by signaling trades based on a periodic sampling of the price trends of each ETF, the investment becomes market-sensitive and capable of producing the significantly better returns shown and with lower risk as indicated by the higher Sharpe Ratio. You can also see that DIs create value by monetizing the combination of ETFs in the Dynamic Investment format. This is value that is lying dormant in every ETF product line today. This amazing benefit of using DIs is discussed in detail the Introduction to Dynamic Investments book that is available for purchase in the NAOI Store.

A Game-Changing Discovery

The NAOI understands that the observation that equity prices are cyclical and that uncorrelated assets move up and down at different times is not a new discovery. Market cycles and momentum investing have been studied and used for years.

The significant breakthrough that the NAOI has made is the creation of a simple investment type that enables the investing public to easily take advantage of the predictive information available in market cycles. This is not insignificant. The high returns produce by Dynamic Investments are typically found only in the dark realm of hedge-funds. Via Dynamic Investment Theory, the NAOI has brought these high returns, without excessive risk, directly to the average investor in a simple, easy to understand and user-friendly manner.

Benefits for Investors and the Financial Industry

NAOI students who have been field-testing Dynamic Investments for multiple years tell us that DIT is the approach to investing they need to confidently enter the market without fear. As a result of this input and years of testing this approach, the NAOI is now including incorporating it into our extensive investor education network and we expect the demand for its use to grow. Learn about the benefits of using DIs for individual investors at this link.

Financial organization who learn about and plan for the demand for Dynamic Investments will capture this new influx of clients and gain a massive competitive advantage in a crowded market. Learn about the benefits of offering DIs for the financial services industry at this link. The NAOI can help financial advisors and organizations integrate Dynamic Investments and Portfolios into their product lines in a profitable and cost efficient manner via a consulting agreement as discussed at this link.

Learn about Dynamic Investments at this link.