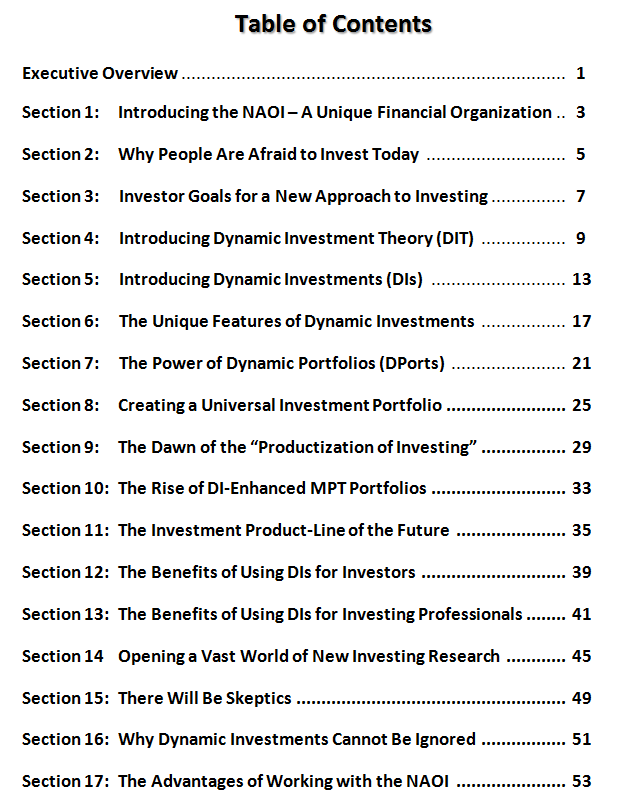

Presented below on this page is the White Paper Table of Contents along with a short overview of the content of each Section. Readers of this document will be among the first to learn how Dynamic Investments and Dynamic Portfolios will change how investing works at a fundamental level and usher in a simpler, safer and more profitable era of investing. And how they can take full advantage of it NOW.

Created based on a multi-year R&D project by the NAOI, using extensive input from the investing public, the new approach to investing described here will enable thousands, if not millions, of individuals to enter the market who are now on the sidelines in fear of holding static, MPT-based portfolios in modern volatile markets. And they will search for financial organizations and investment advisors that offer it as a part of their product-lines.

The NAOI Research Report Table of Contents

An Overview of the White Paper Sections and Addenda

Presented below is a brief overview of each Section of the White Paper.

Section 1: Introducing the National Association of Online Investors (NAOI)

Founded in 1997 with the goal of empowering individuals to invest with confidence, the NAOI is now the premier supplier of objective education and innovative wealth creation solutions to the investing public. As a result of interacting with hundreds of students, we have an unmatched knowledge of how individuals view the field of investing and how they make investing decisions. We also are a major influencer on how people invest today and the financial advisors / organizations they choose to work with. In this Section you will learn how the NAOI is structured to both empower individuals to invest with success and to show investment advisors and financial organizations how to capture these individuals as clients. Click here for more information on the NAOI.

Section 2: Why People Are Afraid to Invest Today

As we teach individuals, they teach us. From their input we know that far too many people who need investing income are not participating in the market today. In this Section you will learn why. One major problem stems from the financial industry’s exclusive use of Modern Portfolio Theory (MPT) methods to create and manage portfolios today. Introduced to the market in the 1950s, MPT dictates that portfolios be customized to match the risk profile of each investor and then held for the long-term, regardless of economic and market conditions. People tell us, in increasing numbers, that they are unwilling to expose their financial futures to the risks of holding static portfolios in modern, volatile markets. Based on this input the NAOI initiated an R&D project to find an alternative to, or supplement for, MPT; one designed to more effectively cope with modern markets and better meet the wants and needs of investors.

Section 3: Investor Goals for a New Approach

To begin our R&D effort we asked our students and the public at-large what they wanted/needed in a new approach to portfolio design and management that would enable them to participate in the market with confidence and without fear. In this Section you will learn their top goals for such an approach. This is information that ALL financial advisors and organizations must have in order to offer investment products and investing methods that will attract clients in today’s market.

Section 4: Introducing Dynamic Investment Theory (DIT)

With investor goals in hand, we immediately saw that MPT methods met none of them. So we began a research effort with a blank slate; as if MPT didn’t exist. In this Section you will learn that we turned to the field of investing Quantitative Analysis (QA) for solutions. There we discovered the remarkable power of market price trends to predict future market movements - a factor totally ignored by today’s MPT-based portfolios. Extensive research and testing showed us how to take advantage of this power in a simple, safe and profitable manner. Using this information we created a new portfolio design and management approach called Dynamic Investment Theory (DIT). You will learn how DIT was developed and what it says in this Section. DIT is the first viable alternative to MPT that will be made available to investors in 70+ years.

Section 5: Introducing Dynamic Investments (DIs)

Dynamic Investments un;lock the wealth creation potential of equity markets

DIT sets the logic and the rules for the creation of a new investment type that we call Dynamic Investments (DIs). DIs are capable of changing the ETFs they hold based on a periodic sampling of market price trends. By doing so, they are "market-sensitive" and capable of producing returns that are significantly higher than virtually any existing ETF, Mutual Fund or MPT-based portfolio, in both bull and bear markets, with lower risk and absolute protection from market crashes.

DIs enable the NAOI to meet ALL of the goals set for us by the investing public. In this Section you will learn how DIs are created, how they work, the performance they can produce and how financial advisors and organizations can gain a massive competitive advantage in the market by offering them. You will also be given the design of simple but powerful DIs that can be used immediately as either standalone investments or as building blocks that will greatly enhance the performance of the MPT-based portfolios you currently offer. Dynamic Investments are the key to unlocking the full wealth creation potential of equity markets - something that MPT portfolios don’t, and can’t, do.

Section 6: The Unique Features of Dynamic Investments

The investing world has never seen an investment type like DIs. In this Section you will learn that one simple DI can serve as an investor’s complete portfolio; one that will outperform just about any MPT portfolio being offered today. Or DIs can be used as building blocks in a traditional MPT portfolio as discussed in Section 7 that follows. DIs are the market’s first “comprehensive investment type. They specify the ETFs to work with and have an internal trading plan that automatically signals which of these ETFs is to be held based on a periodic sampling of market trends. As a result, no subjective, human judgments are required to manage them - thus removing a major risk element that MPT portfolio holders must deal with. Owners of DIs simply buy and hold them, confident in the knowledge that the DI is constantly monitoring the market and signaling trades to as needed to capture gains and avoid losses.

Section 7: The Rise of Dynamic Portfolios (DPorts)

Even though DIs can serve as complete portfolios, it is NOT the intention of the NAOI to replace MPT with DIT; they work quite well together. In this Section you will learn how inserting DI building-blocks into traditional MPT portfolios, as illustrated in the diagram below, will make them market-sensitive and by doing so increase their returns and lower their risk. We call these MPT/DIT-hybrid portfolios “Dynamic Portfolios”. You will also learn in this Section that DPorts take advantage of FOUR diversification elements; these being Company, Asset-Class, Time and Methodology Diversification - by using both a DIT buy-and-sell segment and an MPT buy-and-hold segment - taking advantage of the benefits of each. It should also be noted that while the two diversification elements used by MPT portfolios - company and asset class - both reduce risk and reduce returns, the diversification elements used exclusively by DIT, time and methodology, reduce risk and enhance returns!

an example of the components of a dynamic Portfolio - % allocations to each are a design decision

Extensive NAOI testing shows that performance goes up, without additional risk, as the allocation of money to the DI building block increases.

Section 8: The NAOI Universal Portfolio and the “Productization of Investing”

The world of investing today suffers from the lack of a “default” portfolio that works for all investors regardless of their risk profile. Such a portfolio is not possible using MPT methods that must be customized to match a “guesstimate” of each investor’s risk tolerance. In contrast, DIT-based portfolios are designed to maximize returns while minimizing risk in all economic conditions; a goal that works for all investors regardless of their risk profile. As a result, using DIT methods, the NAOI has created a simple but powerful “Universal Portfolio” that meet the needs of all investors without the need for customization. You will learn how it is designed in this Section.

The NAOI Universal Portfolio can be seen as the market’s first “consumer product”, one that can be sold off-the-shelf, directly to the public by a variety of vendors. It opens the door to the “Productization of Investing”; the Holy Grail of the financial world. You will learn how in this Section.

Section 9: The Benefits of DIs for Investment Buyers and Sellers

This Section shows how the introduction of DIs and DPorts will provide powerful benefits to both investment buyers and sellers.

Benefits For Individual Investors. DIs and DPorts meet all of the goals given to us by NAOI students, and numerous focus-groups, for a new approach to investing as discussed in Section 3. These goals include being given portfolios that are simple to understand, produce higher returns with lower risk than the MPT portfolios they are given today and provide absolute value protection from market crashes. By automatically signaling trades based on objective samplings of price trends, DIs also eliminate a massive human-risk element that is the source of much that is wrong with investing today.

Benefits For Financial Advisors and Organizations. Investing professionals will benefit from the introduction of DIs by being able to easily, quickly and inexpensively create and offer a complete line of powerful DIs and DPorts for a full range of investing goals. These DIs will outperform virtually any investment in an organization’s current product line. And adding DIs as building blocks to traditional MPT portfolios will both increase their returns and reduce their risk. By offering these superior products, advisors and financial organizations will have the competitive advantage needed to expand their client base, increase revenues and add value to their balance sheets by creating new proprietary products. In addition, DIs monetize the combination of existing ETFs, and by doing so uncovering massive value that is currently lying dormant in current ETF product lines.

Many more benefits of using DIT methods and the DI investment type are discussed in the White Paper.

Section 10: Opening a Vast New World of Investing Research

In this Section you will learn how, by breaking out of the decades-old “MPT box”, a vast and virgin world of new and profitable investing research opens its doors. By inserting the predictive power of market trends into portfolios, along with an automated and objective trading plan, DIT and DIs enable a vast array of valuable benefits that are not available today. Among these the creation of portfolios that produce higher returns without higher risk, portfolio designs with 4+ diversification elements, the development of a universal portfolio that works for all investors and the “productization of investing” as discussed Section 8. DIT also calls into question how investing risk is measured today and why current methods are dangerously flawed.

Section 11: There Will Be Skeptics

Any time a change is proposed to the financial world that is as significant and disruptive as DIT and DIs, there will be skeptics. This Section discusses input from investing professionals who we have invited to review the the new approach. More than a few gave us reasons why the new approach can’t possibly work. In this Section we respond to each objection. We have yet to hear one reason that would cause us to question the superiority of the DIT approach.

Section 12: Why Dynamic Investments Cannot Be Ignored

The NAOI is well aware that many financial organizations are profiting handsomely from using current MPT methods and will prefer to ignore the DIT-based approach that you will learn in the White Paper. That would be a mistake for several reasons.

First, if your competitors offer DI-based products and portfolios that deliver returns significantly higher than the portfolios you are offering today, with lower risk, you will lose clients to them.

Second, the NAOI is perfectly positioned to make the investing world aware of the higher performance and many other benefits of using DIs via our extensive education network as well as via the hundreds of contacts we have in the financial media and in major financial organizations; all of whom are watching this development very closely.

Third, the NAOI will soon release the Dynamic Investment User’s Manual, pictured at right, that will be available on multiple publishing platforms including Amazon where it can reach millions of potential investors. NAOI students tell us that readers of this Manual will look for financial organizations that offer the DIT approach and the DI investment type. If one can’t be found, they will be able to create and manage DIs on their own, using this Manual, an online broker and support from the NAOI.

DIT and DIs represent an evolutionary change that adapts how investing works today to cope with modern markets. Those that offer it will thrive in the future of investing. Those that continue to offer only 1950s-era MPT-based portfolios will struggle to survive. That’s just how evolution works.

Summary: The Future of Investing Is Here - NOW!

As long as Modern Portfolio Theory (MPT) is the only industry-approved standard for the design and management of portfolios, the world of investing will not evolve to reach its full profit potential for both investment buyers and sellers. MPT was introduced in the 1950’s when the market was a far different place than it is today. While markets have evolved significantly since then, MPT has barely changed at all. And it simply can’t cope with modern markets. In this White Paper you will learn that the NAOI has broken out of the “MPT box” and opened a powerful pathway for the much-needed evolution of investing.

As a reader of the NAOI White Paper you will have the information needed to begin planning for, and creating, a full product-line of Dynamic Investments and Portfolios (Click the button below to view what this new product-line will look like). And those who do so first will have a massive competitive advantage over those that continue to offer only portfolios designed based on a theory introduced to the market over 70 years ago.

Addendum 1: The Advantages of Working with the NAOI

After reading the above Sections of the White Paper you will have the knowledge and tools needed to begin creating and using Dynamic Investments and Dynamic Portfolios on your own, immediately.

But to fully exploit the power of this evolutionary approach to investing you would be well advised to consider a cooperative effort with the NAOI. We have been creating and testing DI configurations for 3+ years using a customized DI Development and Testing Platform. And we have been teaching their use to students for over two years. We know what works and what doesn’t. We know what the public will buy and what they won’t. And we know how to erase the public’s fear of investing that keeps them on the market sidelines in fear of MPT methods.

Based on our knowledge, experience and resources, we can assist you in creating a full product line of DIs and DPorts months, if not years, ahead of your competition. The ROI of a cooperative agreement with the NAOI will be off-the-charts high. (Click the button below to see why.)

Addendum 2: DIs and DPorts You Can Begin Using Today!

In the White Paper I have discussed the design of several very powerful Dynamic Investments and Dynamic Portfolios. In this Addendum I show you the ETFs that we placed in the Dynamic ETF Pool for each. With this information you can begin using them immediately upon completion of the last Section. You can use each as a total portfolio or as a building block in the MPT portfolios you create today in order to both reduce risk and enhance returns.

It Is Time for Action!

Return to the top of this page to order this seminal White Paper now. Your competitors are reading it. And the modest price for purchasing it will never be as low as it is now.

Still Not Convinced? Let’s Talk.

As a member of the financial services industry for 20+ years, I, Leland Hevner, realize that fundamental change of the nature described in the White Paper will not be easily accepted by the financial services industry. So I am offering to you, as a reader of this Web page, a free phone consultation that will show you why reading this White Paper can be the best investment you can possibly make at this point in time. To do so, contact me at LHevner@naoi.org to set up a time.