Shop and Buy with Confidence

Welcome to the NAOI store. Here you can easily and securely purchase NAOI products. Signup for our Email Updates list at the bottom of any page on this site to be notified when new products become available for sale.

The Investing Book that Changes Everything!

The NAOI is pleased announce the release of the most significant investing book available to the public in decades. It is described, and you can purchase it, below. Whether you are an individual investor or a financial professional, if there is only one investing book you read this year, this is the one. The new investing approach it describes will shock, amaze and excite you. And you will be able to use what you learn immediately upon completing the final chapter in order to achieve investing returns that today's "experts" will say are impossible. Enjoy!

The Amazing Future of Investing

Introducing Dynamic Investments

& Market-Sensitive Portfolios

Book Details

Title: The Amazing Future of Investing: Introducing Dynamic Investments and Market-Sensitive Portfolios

Author: Leland B. Hevner

Publish Date: April, 2018

Format: 8.5" x 11.0" Comb-Bound Book for lay-flat, easy study

Pages: 222

Price: $249

Publisher: The National Association of Online Investors (NAOI), Orlando, Florida, USA

Discount Codes: If you have a Discount Code, enter it during the order process after clicking the "ADD TO CART" button at right.

Volume Discounts Available: Contact the author at LHevner@naoi.org for corporate volume discounts

To Purchase: Click the "ADD TO CART" button below the cover picture at right. This will start the simple and secure order process. Your book will be shipped via USPS Priority Mail!

Book Description

5+ years in the writing, this book changes the world of investing at a fundamental level. It transforms the way we invest from today's "static", buy-and-hold portfolio design approach to a far more profitable and less risky "dynamic", buy-and-sell approach.

In this book you will learn how a new investment approach, called Dynamic Investment Theory (DIT), and a revolutionary investment type that DIT creates, called Dynamic Investments (DIs), change everything in the world of investing. Among these changes are the following:

Investing becomes exponentially simpler

Returns are significantly higher

Risk is significantly lower

Portfolios are "market-sensitive" able to automatically signal trades based on market trends

Trade decisions are made based on objective observations of market data instead of on subjective analyst opinions, thus reducing the risk of human error, sales bias and even outright scams

Portfolios become standardized investment "products" instead of customized creations i.e. the world of investing becomes "productized"

In this new era of investing, individual investors are finally given the keys needed to unlock the substantial wealth generation power that equity markets offer in any economic environment. And financial organizations who embrace this change will see their revenues soar as investors who are currently on the sidelines in fear will enter, or re-enter, the market by the millions.

Who MUST Read this Book?

Individual investors of all experience levels who study the material in this book will finally be empowered to invest with confidence and without fear. And they can reasonably expect to earn returns that are significantly higher than the static, asset-allocation portfolios they are advised to hold today.

Financial professionals and organizations who embrace this new investing approach will be able to immediately and substantially improve their investing products / services in a manner that immediately opens significant new revenue streams and gives them a massive competitive advantage in the crowded field of financial services.

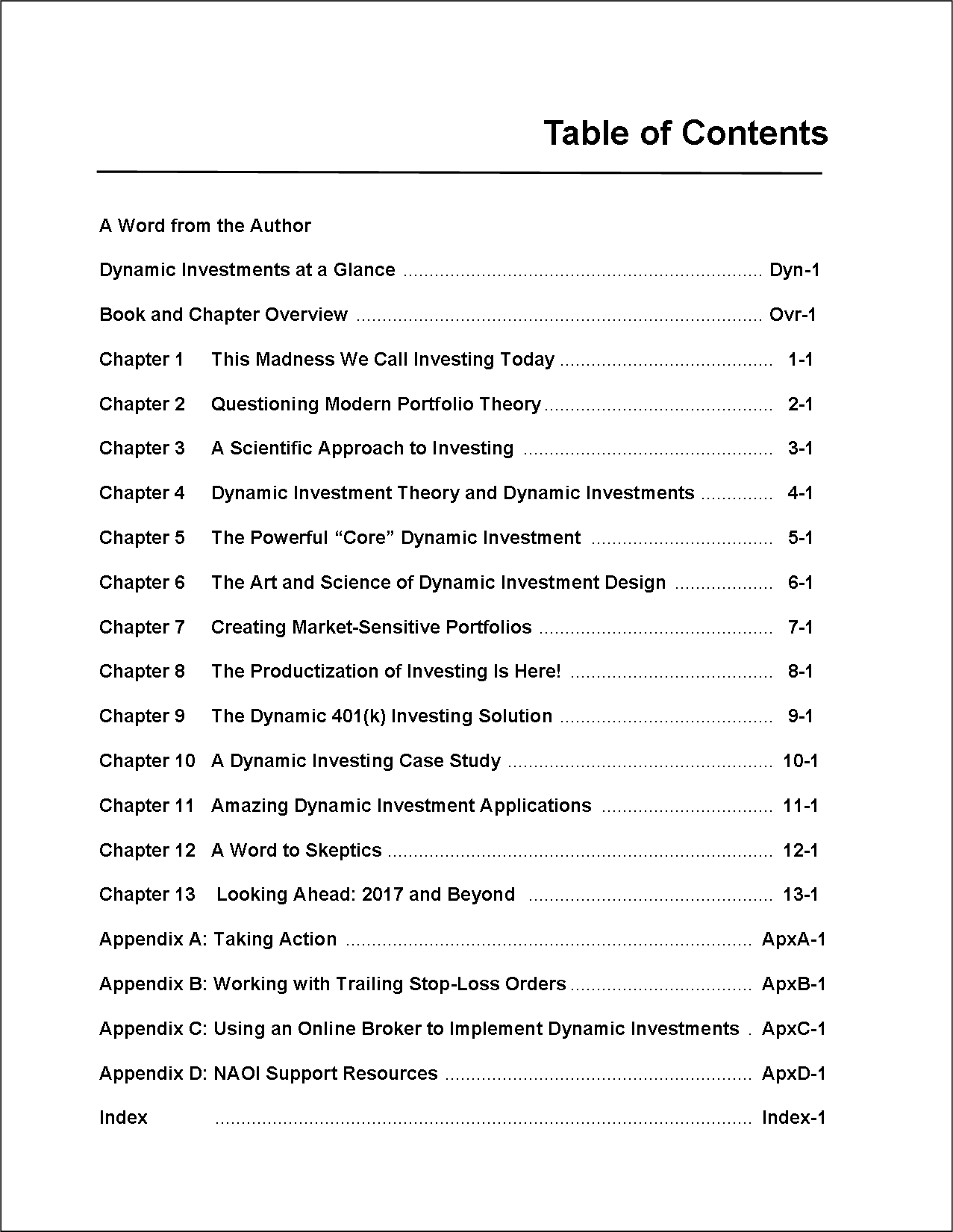

Table of Contents

This is the ONE book that defines how we will invest for decades to come. The book's Table of Contents shows how.

The New Evolution of Investing Timeline

With the release of this book the world of investing evolves from the 1950's to the 21st Century. Below is the new Evolution of Investing Timeline with major evolutionary advances listed.

1952 - Introduction of Modern Portfolio Theory and Asset-Allocation Portfolios ( Markowitz - Awarded Nobel Prize )

1980 - Introduction of Mutual Funds

1992 - Introduction of Exchange Traded Funds

2018 - Introduction of Dynamic Investment Theory and Market-Sensitive Portfolios

Change WILL happen. In addition to being a premier investment research organization, the NAOI is the market's leading provider of objective, comprehensive investing education to the public. When individual investors learn about the simplicity, higher returns and lower risk of NAOI Dynamic Investments, they will demand them. To meet this demand financial service organizations will need to embrace the DIT portfolio design approach to meet it. Those organizations who do not change will lose bushiness and fade away. That's just how evolution works.

Not Just Another "Investing Book"

The Amazing Future of Investing is not just another "how-to" investing book that you can find by the dozens on Amazon for $19.95. A major problem with virtually all of these books is that they take as a "given" that the underlying investing approach used will be Modern Portfolio Theory (MPT) which, as discussed above, is based on 1950's era thinking. Then, authors simply layer on top of this obsolete model various techniques that they claim will make a major difference in your investing success. They are simply putting lipstick on the MPT "pig". Most such books end up on bookshelves collecting dust.

breaking the MPT chains

The Amazing Future of Investing book is different. The NAOI started the search for a new investing approach with a "blank slate", as if MPT didn't exist. Unconstrained by MPT "chains" we developed a new theory of investing called Dynamic Investment Theory (DIT) designed to thrive in 21st Century markets. The book walks you through the steps we took to do so. This is NOT a "black box" trading system - far from it.

Then we show how this new theory creates dynamic, intelligent investments that are sensitive to market movements and capable of changing their holdings automatically based on current market trends. By doing so, extensive testing showed to us that these new Dynamic Investments are capable of consistently producing higher returns with less risk than any static, buy-and-hold MPT portfolio in existence. Creating this simpler, more profitable and less risky investing environment was possible ONLY because we broke the constraints of MPT and used logic and scientific methods to develop a totally unique approach to portfolio design and to investing in general.

No, this is NOT just another investing book. It is in a class by itself.

What About the Price?

Granted, this book is priced above other books that claim to show you how to "invest with success". But as discussed just above, this is not simply a book on "how to invest". This is a book that first shows why current methods of investing don't work in today's markets and then replaces them with improved methods that do. With the constraints of MPT broken, we then show readers how to achieve investing returns that today's "experts" will say are impossible: with DIT, + 20% and higher average annual returns for extended time periods are not out of the question. The price is dwarfed by the additional investing income that can be achieved, over an investing career, by those who learn the information presented in the book and act on it.

Financial organizations regularly pay tens of thousands of dollars for consulting contracts and studies that provide far less valuable and actionable information than is found in this book. Organizations that embrace the DIT approach will be empowered to create and offer superior investing products/services that will enable them to capture new market share, open massive new revenue streams and gain a significant competitive advantage in a crowded market. The ROI of purchasing this book will be through the roof!

For financial professionals and organizations the NAOI also offers consulting services as discussed here that will show how to integrate Dynamic Investments into their offerings easily, efficiently and cost effectively without disrupting current operations!

Organizations that prepare NOW to offer DIs as a part of their product offerings will thrive in the future of investing. Those that don't, will miss a once-in-a lifetime opportunity to rise above their competition and dominate the future of investing.

Proof of Concept

Theory is all well and good but what about performance? Does DIT actually work?

Yes it does. In this book you will learn how the simplest possible Dynamic Investment, one that automatically rotates its holding only between a Total Stock Market ETF and a Total Bond Market ETF, earned the returns shown in the top data row of the table below for the 10 year period from the start of 2008 to the end of 2017. These returns are compared to those produced by a traditional MPT portfolio, shown in the bottom data row, using the same ETFs with the allocations shown. Note the astounding Average Annual Return Rate of the DI for the period. The Sharpe Ratio, displayed in the last column is a measure of how much return was achieved for each unit of risk taken - the higher the better. This example shows that the DI's higher returns DID NOT require exposure to higher risk. MPT says that this is impossible. DIT begs to differ.

We call the DI used in this example the NAOI Core DI. You will be able to implement it and other NAOI designed DIs, immediately upon completion of the book! And you can do so on your own, using an online broker if you wish. The book provides step-by-step instructions for doing so!

Additional Information

This site provides additional information on how Dynamic Investment Theory and Dynamic Investments work. To review it we suggest that you hover your mouse over the Dynamic Investing item on the Navigation Menu and select the topic of interest. Then, be among the first to enter the future of investing using 21st Century methods by purchasing The Amazing Future of Investing while it is still available at a discounted price.

Further information is available by contacting the author directly via email at LHevner@naoi.org. And please consider joining our Email Updates List at the bottom of this page to be alerted to new developments as the arise.

investing just became simpler, more profitable and FUN!