Coming Soon - The Book that Changes Everything:

"An Introduction to NAOI Dynamic Investments

and Market-Sensitive Portfolios”

Current Release Date Projected for May 4, 2020

Join the NAOI Updates Email List at the bottom of this page to be notified when the book is available for purchase!

In response to public demand, the NAOI has suspended the sale of “The Amazing Future of Investing” book and will replace it with the book shown on this page entitled “An Introduction to NAOI Dynamic Investments and Market Sensitive Portfolios”. While both books discuss the same topic, as described on this Web site, the new book is shorter (only 70 pages), easier to read, provides more examples of Dynamic Investments that individuals can use today, contains updated content and has a substantially lower price.

To learn why Dynamic Investments are desperately needed by both individual investors and the financial services industry to cope with modern, volatile markets and how they work start at this link.

Investors using NAOI Dynamic Investments and Dynamic Portfolios would have actually made money during the stock market crash of 2008-2009 and would have been out of the market with minimal loss during the Corona Virus induced market crash in the first quarter of 2020.

This is the book shows investors of all experience levels how to create portfolios that provide the market-crash protection that is essential in today’s volatile markets. And it shows financial advisers and organizations the benefits of including Dynamic Investments in their product offerings. By doing so they will gain a massive competitive advantage in a crowded field.

Book Details

Title: The Amazing Future of Investing: Introducing Dynamic Investments and Market-Sensitive Portfolios

Author: Leland B. Hevner

Publish Date: April, 2020

Format: 8.5" x 11.0" Comb-Bound Book for lay-flat, easy study

Pages: 70

Price: $99 - for a limited time only

Publisher: The National Association of Online Investors (NAOI), Tampa, Florida, USA

Discount Codes: If you have a Discount Code, enter it during the order process after clicking the "ADD TO CART" button at right.

Volume Discounts Available: Contact the author at LHevner@naoi.org for corporate volume discounts

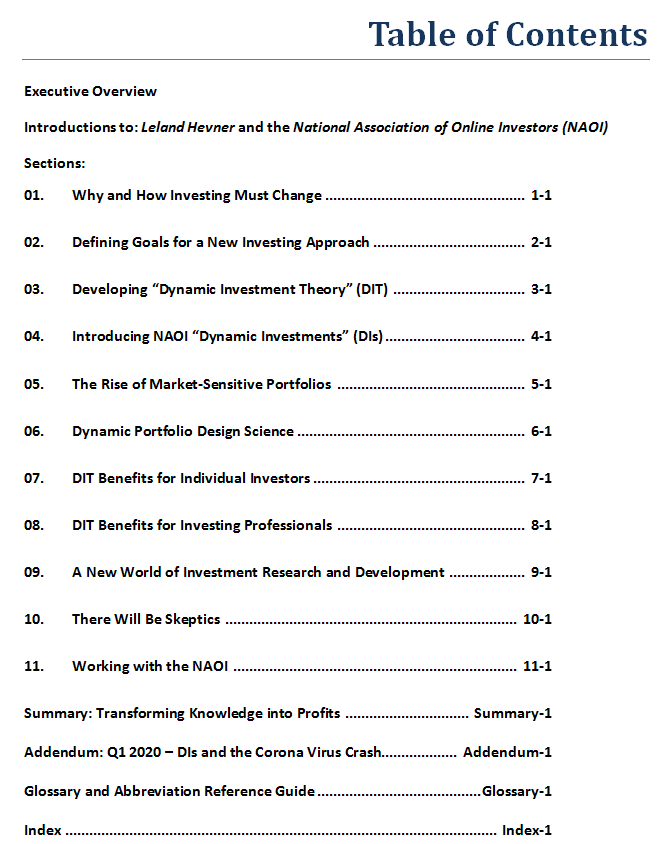

Book Table of Contents

Book Description

Written based on a 5+ year research project conducted by the NAOI, this book changes the world of investing at a fundamental level. It transforms the way we invest from today's "static", buy-and-hold portfolio design approach to a far more profitable and less risky "dynamic", buy-and-sell approach. In this book you will learn how a new investment approach, called Dynamic Investment Theory (DIT), and a revolutionary investment type that DIT creates, called Dynamic Investments (DIs), change everything in the world of investing. Among these changes are the following:

Investing becomes exponentially simpler

Returns are significantly higher

Risk is significantly lower

Portfolios are "market-sensitive" able to automatically signal trades based on market trends

Trade decisions are made based on objective observations of market data instead of on subjective analyst opinions, thus reducing the risk of human error, sales bias and even outright scams

Portfolios become standardized investment "products" instead of customized creations i.e. the world of investing becomes "productized"

In this new era of investing, individual investors are finally given the keys needed to unlock the substantial wealth generation power that equity markets offer in any economic environment. And financial organizations who embrace this change will see their revenues soar as investors who are currently on the sidelines in fear will enter, or re-enter, the market by the millions.

2008 - 2019 Performance of a Simple Dynamic Investment

The table below shows the returns of a simple NAOI Dynamic Investment (DI) that rotates between a Total Stock Market ETF and a Treasury Bond Market ETF based on quarterly sampling of the price trend of each. Its performance is compared to the returns of a traditional MPT portfolio with a 60% allocation to a Total Stock Market ETF and a 40% allocation to a Total Bond Market ETF.

The simple Dynamic Investment created by the NAOI produced returns that are impossible using the MPT portfolios that individuals are given by advisors today. And they did so with lower risk as indicated by the Sharpe Ratio that is a measure of how much return is received for each element of risk taken. You will learn how this DI works and how to begin using it immediately in the above described book.

Who MUST Read this Book?

Individual investors of all experience levels who study the material in this book will finally be empowered to invest with confidence and without fear. And they can reasonably expect to earn returns that are significantly higher than the static, asset-allocation portfolios they are advised to hold today.

Please note that this book provides investor education, not investing advice. The NAOI is not a financial advisory organization.

Financial professionals and organizations who embrace this new investing approach will be able to immediately and substantially improve their investing products / services in a manner that opens significant new revenue streams and gives them a massive competitive advantage in the crowded field of financial services.