Slide Show Home << Previous Next>>

The NAOI Value Proposition

The National Association of Online Investors is offering to both the investing public and the financial services industry a new approach to portfolio design and to investing in general that data shows works significantly better than the standard methods used today and the implications or its use are enormous.

The question then arises as to what enables the NAOI to make these fundamental changes with any degree of credibility? This question is answered on this page that discussed the NAOI value proposition.

The Hyper-Effective NAOI Structure

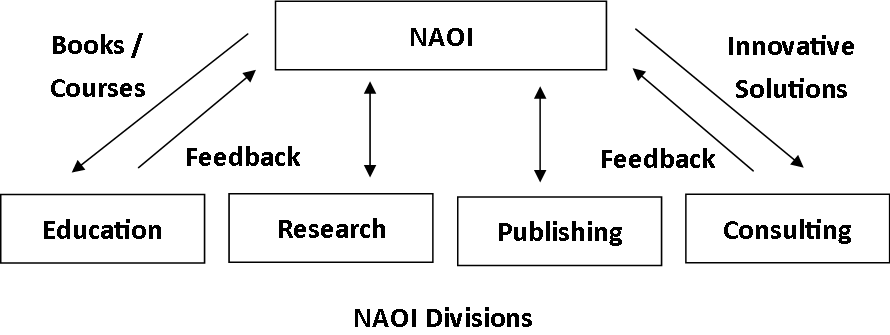

The organizations structure of the NAOI s designed specifically to evolve the world of investing to better meet the needs of both individual investors and the financial services industry. We do this by interacting with both investment buyers and investment sellers to create investing solutions that benefit each. Our organization chart and information flows are shown in the following diagram and the function of each is explained following it.

Each NAOI Division contributes to the NAOI’s ability to evolve the world of investing to a better place. The following discussion explains how.

The NAOI Education Division

As a leader in personal investor education, the NAOI works with hundreds of individual investors on a yearly basis. We not only provide them with world-class education, we also actively solicit their feedback as shown in the above diagram. This feedback loop enables us to continually upgrade our education offerings to better meet the needs of our students. When we uncover a problem faced by individual investors that education cannot solve, we engage the NAOI Research Department.

The NAOI Research and Development Division

This division is called into action when the investing public shows us a problem they face that cannot be overcome with more or different education. These are problems that are structural in nature such as those related to the almost exclusive use of Modern Portfolio Theory for portfolio design. An example is the struggle that investors face when asked by advisors to define their risk tolerance - a critical, yet very unscientific, process that can determine the wealth accumulation potential of the client. When faced with problems that have no solution based on scientific method, the NAOI turns from education to innovation and the NAOI R&D Division gets involved. The development of Dynamic Investment Theory and Dynamic Investments is an example this divisions output. As you will learn on this site, DIT portfolio design methods are not based on matching the investor’s risk profile. All new developments are sent to the NAOI Education Division where are documented and incorporated in NAOI courses.

The NAOI Consulting Division

When the NAOI releases major developments we then involve our Consulting Division to demonstrate and discuss how they work and how advisors and financial organizations can profit from them. With the understanding that the NAOI is teaching the public not only how to use these developments but to demand them of their advisors, the financial professionals and companies that take advantage of NAOI consulting services will be able to attract the business of thousands of new clients and generate significant new revenue sources. As shown in the above diagram we also solicit feedback from financial professionals that can result in the NAOI modifying our new investing products and/or methods. This is another feedback loop that is critical to the advancement of the investing world.

The NAOI Publishing Division

The NAOI Publishing Division gives us control of how our education and new developments are communicated to both the public and to the financial services industry. Extensive experience has shown us that different book formats are required for different audiences. Students prefer comb-bound workbooks that allow for “lay-flat” study. Information books intended to reach a more general audience utilize a standard paperback format that is easier to mass produce and costs less to create. By having an in-house publication capability we can create the format desired by the book’s target market. This is another element that makes the NAOI unique in our goal of advancing the world of investing.

Two Books Published by the NAOI

The two books shown below illustrate how we work with multiple areas of the investing market. The book at left is a simple users-manual for individual investors who want to take advantage of the simplicity and power of Dynamic Investments. Because DIs are so simple to use the education required is minimal and the book is short. It shows readers, step-by-step how to implement and manage DIs using an online broker for those who are self-directed investors. For those who prefer to work with an advisor, it shows the performance that even the simplest DIs produce and gives individuals a performance standard to demand from any portfolio that they are given. This book will also be made available on Amazon in order to reach a massive market looking for a better way to invest.

The book at right targets financial professionals. It shows in more detail how Dynamic Investments work, how they are designed and how advisors and financial organizations can integrate them into their current offerings and by doing so generate more revenues with minimal disruption to current operations.

Note that these books will be released in the Spring of 2019.

Why the NAOI?

The above discussion shows that by working both with investment buyers and investment sellers the NAOI is uniquely capable of effecting significant change in the world of investing. Our experience, knowledge, resources, corporate structure and willingness to ‘think differently” are the components of the NAOI value proposition and answer the question: “Why the NAOI?”