Pre-Release Access to the Seminal NAOI Research Report

that Makes Investing Simpler, Safer and More Profitable

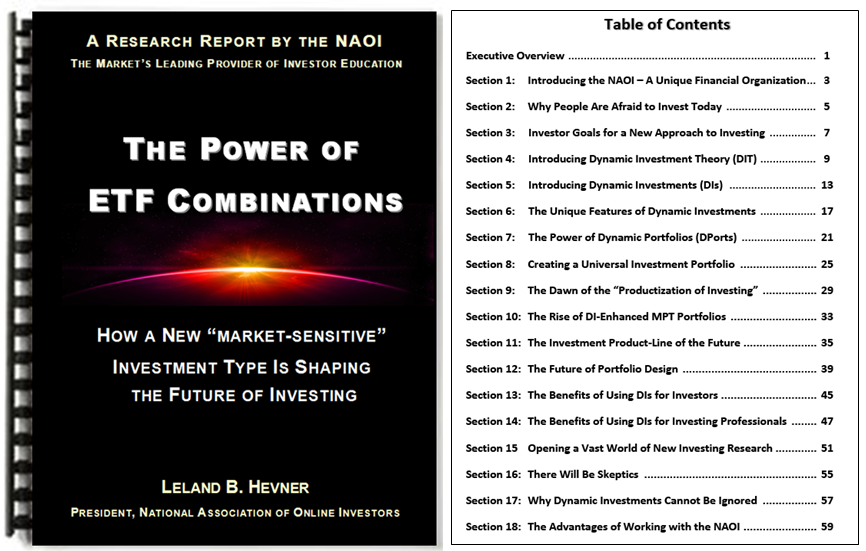

Welcome to an invitation-only Web page that gives a select few of my Linked-In contacts pre-release access to an NAOI Research Report entitled “The Power of ETF Combinations” (shown below) that changes the world of investing at a fundamental level.

Presented on this page is an overview of why this change is needed, how it works and how your organization can use it to gain a massive competitive advantage in the crowded world of financial services today.

The NAOI Research Report that Changes Everything

The NAOI Research Report shown below shows how the NAOI is making investing simpler, safer and less risky than it is today. Financial organizations that read it and offer the new investment type described will hold a massive competitive advantage over those that remain stuck in the 1950s era “MPT box”.

The Research Report can be accessed via a link at the bottom of this page.

This Research Report introduces and describes the future of investing!

Why Change Is Needed

The world of investing today is stuck in the past. The financial services industry is still using Modern Portfolio Theory (MPT) to design portfolios. MPT was introduce to the market in the 1950s. While markets have evolved significantly since then, MPT methods have barely changed at all. An their buy-and-hold management strategy simply does not work in today’s volatile and uncertain markets. As a result, the NAOI is seeing far too many individuals who need investing income leaving, or not entering, the market. This needs to change, now.

Click here to see examples of why MPT portfolios are not optimal in today’s investing environment.

To bring the world of investing into the 21st century and to enable thousands, if not millions, of individuals to participate in the market with confidence and without fear, the NAOI initiated an R&D effort to find an alternative for, or supplement to, MPT for designing portfolios. One that is capable of thriving in modern markets.

Following a multi-year effort, we succeeded in this effort with the development of a new theory of investing called Dynamic Investment Theory (DIT) and a “market-sensitive” investment type it creates that we call Dynamic Investments (DIs). An overview of each is presented just below.

Introducing Dynamic Investment Theory (DIT); an Alternative to MPT

To replace, and/or supplement, MPT portfolio design and management methods the NAOI has created an updated theory of investing called Dynamic Investment Theory (DIT) that is the first alternative to, or supplement for, MPT portfolio design methods in over half a century. It is explained in detail in the NAOI Research Report shown above.

DIT recognizes the fact that markets and equities that tract them move up and down in regular intervals over time. And different markets move in opposite directions over time (e.g. stocks and bonds). The new theory states that it is possible to create a new investment type that is capable of automatically detecting market movements and purchasing only ETFs tracking markets that are moving up in price while avoiding, or quickly selling ETFs that are trending down. By doing so they give investors the higher returns that they want along with the strong protection from losses that they need.

The new investment type that DIT created is called Dynamic Investments (DIs). They are discussed below.

Introducing Dynamic Investments (DIs)

DIs are a unique investment type that are “market sensitive”. They automatically change the ETF they hold based on a periodic, automatic sampling of market trends. By purchasing only ETFs moving up in price while avoiding, or quickly selling, ETFs that are trending down, extensive testing shows that DIs produce higher returns with lower risk than virtually any mutual fund, ETF or even MPT portfolio being offered today. And they do so in all market conditions - bear or bull.

The Dynamic Investment (DI) Components

The components of DIs are shown in the picture just below. Each is a variable defined by a DI designer. Readers of NAOI Research Report will learn how to easily design an unlimited number of high performance, low risk DIs for a full range of investing goals by selecting the values of these components. Each is discussed below the picture and explained in detail in the Reprt.

1. Dynamic ETF Pool (the DEP) - The DEP is where a DI designer places a group of uncorrelated ETFs (typically from 2-5) that are the DI’s “purchase candidates”.

2. Review Period - This is how often the DI reviews the DEP to purchase, or retain if currently held, the ETF moving up most strongly in price. Quarterly and Monthly are common Review Period selections.

3. Trend Indicator - This is the price trend indicator the designer selects to identify the ETF in the DEP moving up most strongly in price. The ETF selected is purchased, or retained, until the next Review Period when the ETF selection process is repeated. A simple and effective indicator is the ETF price increase since the previous Review.

4. Trailing Stop Loss Order (TSL) - A TSL is placed on all ETFs held by the DI. The ETF held will be automatically sold if its price drops by a designer-specified percentage from the highest price it reached while being owned. 10%, 12% and 15% are commonly used sell-triggers. The NAOI recommends that designers place higher TSL sell triggers on ETFs with higher volatility. If a TSL sale is triggered, the DI purchases and holds a cash-equivalent ETF until the next Review when an uptrending ETF from the DEP is purchased.

These simple components make DIs market-sensitive and capable of producing higher returns with lower risk than virtually any buy-and-hold MPT-based portfolio. Example returns are shown just below.

Example NAOI-Designed Returns: 2008-2024

NAOI designed Dynamic Investment come in many forms and for a wide variety of investing goals. Below are shown just a few examples of the performance of three DIs compared to the performance of an industry standard 60% Stock / 40% Bond Portfolio. The backtest period is from 2008-2024 and the performance figures shown for each of the following examples are the Average Annual Return achieved by each.

Industry Standard 60/40 MPT Portfolio Performance: 2008-2024

Below is shown the average annual return of a financial industry standard MPT-based portfolio for the period from 2008-2024. The portfolio is designed to hold 60% stocks and 40% bonds with quarterly rebalancing.

NAOI Sample Dynamic Investment Performance: 2008-2024

Below are average annual returns for NAOI-designed Dynamic Investments for the same period. Each DI holds only the one ETF from its Dynamic ETF Pool (DEP) that is trending up most strongly in price at a quarterly review.

It can be seen that DIs produce significantly higher returns than the traditional 60/40 buy and hold MPT offered to the public today.

Introducing Dynamic Portfolios

It should be made clear that it is not the purpose of the NAOI to replace MPT with DIT; they work quite well together. We predict that the dominant investment type of the future will be portfolios that use DIs as building blocks in traditional MPT portfolios as illustrated in the picture just below. We call these Dynamic Portfolios or DPorts for short.

MPT portfolios are not market-sensitive. Their buy-and-hold management strategy makes them blind to systemic market risks and dangerously vulnerable to market corrections and crashes due to systemic risks.

Adding DIs as building blocks to MPT portfolios, however, makes them market sensitive and enables them to thrive in all market conditions. The NAOI Research Report devotes an entire Section that shows how to build them.

And example of a DPort is shown below.

Designers will determine the percent of portfolio money allocated to the DIT and MPT Segments as well as the percent of money allocated to each investment type in the MPT Segment.

The Dawn of the “Productization of Investing”

As is presented above, DIs have as their goal maximizing returns while minimizing risk in all market conditions. This is a universal goal that works for all investors, regardless of the risk profile. As a result, Dynamic Investments can be viewed as investing “products” that can be sold via investment product catalogs. Thus they usher in the “productization of investing” - the Holy Grail of the investing world that investment developers have been seeking for decades. They haven’t found it. The NAOI has. And this changes the world of investing at a fundamental level.

The Amazing Benefits Provided by Dynamic Investments

In addition to enabling the Productization of Investing, the Dynamic Investments will provide a plethora of amazing benefits to the world of investing for investment buyers, developers and sellers. Below are just a few.

For Investors:

1. Higher returns with lower risk

For Investment Professionals:

1. Ease of creating superior investment products

2. Monetizing ETF combinations and by doing so significantly increasing the value of existing ETF product lines.

More benefits are discussed at this link.

Why Dynamic Investments Cannot Be Ignored

DIs and DPort are more than just a “good idea”. The NAOI is currently teaching the use of DI and DPorts throughout our extensive education network. And we are developing curricula that enables academia to finally offer investing classes that are not dependent on any one person’s financial profile.

Students tell us that this is the approach to investing and the investment types that will finally enable them to enter the market with confidence and without fear. And they will search for financial organizations that offer them.

Financial professionals who have peer-reviewed DIs and DPorts agree that there currently exists no simpler, less expensive and more effective way of gaining a significant competitive advantage in a crowded market than by including DIs in their product line.

The bottom line is this: Financial organizations the offer DIs will be able to attract far more clients than those that remain stuck in the increasingly outdated “MPT Box”. They cannot be ignored.

NAOI Partnerships

The NAOI offers Partnerships to financial organizations that share our passion for empowering individuals to invest with confidence, success and without fear.

Based on 25+ years of working with the investing public the NAOI has gained a sterling reputation as a strong advocate for the individual investor. A Partnership with the NAOI will elevate any organization’s “trust-factor” with the investing public. This is a significant competitive advantage in a field where a recent CFA Institute survey showed that only 23% of individual investors completely trust their financial advisor.

More information related to NAOI Partnerships is found at this link.

NAOI Advisory Services

NAOI President Leland Hevner is available to join financial organization Advisory Boards. In this role he draws on his 25+ years of working with the investing public to show organizations how to create marketing plans, investing products and investor solutions that will give them a significant advantage over their competitors. Hevner’s CV is found at this link.

In addition, the NAOI is a well-known for assisting and empowering individuals to become successful investors. His presence on an advisory board will give potential clients the assurance that the offerings of a financial organization has been examined and approved by the NAOI.

Investment Product Marketing

No organization in the financial market today has a more in-depth understanding of the wants and needs of the investing public than the NAOI. Using this knowledge the NAOI can help any financial organization gain more clients by not only creating superior investing products but also showing how these product need to be marketed to attract new clients.

The NAOI can supply a complete marketing plan that contains investor education, higher performance / lower risk investing products and uniquely personalized portfolio designs. These marketing plans, customized for each of our clients, will give your organization the competitive advantage needed to standout in the crowded field of investing services today.

Purchase the NAOI Research Report

The cover and TOC of the NAOI Research Report are shown below along with a link where you can purchase it

Your can purchase the Research Report at this link:

Let’s Talk

Feel free to contact NAOI President, Leland Hevner directly at LHevner@naoi.org, or on LinkedIn to learn more about NAOI offerings and how we can work together.

“The Future of Investing Starts Here” is a registered trademark of Leland Hevner and the NAOI.