An Overview of Dynamic Investment Theory

Following the utter failure of MPT-designed portfolios during the 2008-2009 market crash, the NAOI stopped all education activities and began a search for an alternative approach to investing. We could no longer teach design methods that were over six decades old.

The Goals of a New Approach

We began our research by understanding what the investing public wanted and needed to become more effective and confident investors. I was determined that a new approach would be designed by investment buyers as opposed to sellers. Fortunately the NAOI has access to scores of NAOI members, who are average people with money to invest, that we could easily survey. Their top goals are listed below.

A new approach to investing must:

Be easy to understand, implement and manage; enabling individuals to implement and manage their investments on their own if they wish

Provide higher returns than MPT portfolios with less risk and lower expenses

Provide absolute protection from market crashes

Be comprehensive; not only specifying which equities to work with but also how to manage them on an ongoing basis

We quickly saw that MPT met none of these goals so we started with a blank slate; unconstrained by today’s “settled science” rules and concepts.

Using Scientific Methods

To meet investor requirements we followed a scientific process that begin with defining our design goals to be as follows:

To create market-sensitive investments / portfolios, capable of automatically changing the equities they hold based on market price movements

To define a portfolio management process in which trade decisions are based on objective observation of market data, not on the error-prone human subjective judgments as they are today

To design a comprehensive theory of investing that not only includes rules for equity selection but also for when and what to trade

With these goals established we began our research.

Observations, Analysis and a Premise

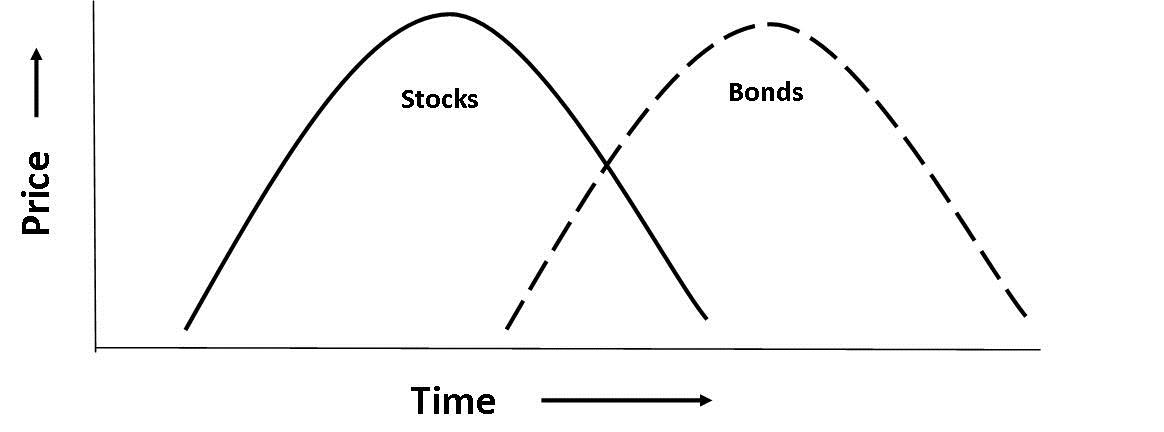

To meet our design goals we analyzed historical market price data looking for patterns the held predictive power for future price movements. Our analysis led us to one very clear conclusion. The only thing we can know about market prices with a high degree of certainty is that they are cyclical and that different asset classes, markets and market segments move up and down at different times as illustrated below.

the cyclical nature of asset pricing

Based on this observation we arrived at the following Premise:

“At all times and in any economic conditions there exist areas of the market that are trending up in price. It is possible to create an investment type that is capable of automatically detecting these areas and capturing their positive returns potential while avoiding areas of the market that are trending down in price.”

Testing and Creation of a Theory

Over a multi-year period we created a large number of prototype investment designs to test our premise and found one design that showed it to be true with a high degree of probability. We called this new investment type NAOI Dynamic Investments (DIs). Based on our test data, and following scientific method rules, we transformed our Premise to a Theory that we called Dynamic Investment Theory (DIT). It met every goal set for us by the public and more.

Breaking New Ground and the Impact

The NAOI understands that the observation that equity prices are cyclical and that uncorrelated assets move up and down at different times is not a new discovery. Market cycles and momentum investing have been studied and used for years.

The significant breakthrough that the NAOI made was the design of a new investment type called Dynamic Investments (DIs) and a related management rule-set that enables average people with money to invest to easily transform equity price cycle information into profitable investing actions. This is not insignificant. DIT brings profitable investing methods, today used almost exclusively by hedge funds, directly to the people in a simple and user-friendly manner.

Dynamic Investments meet every goal set for us by the public as listed above. This fact can enable millions of people to confidently enter the market who are now on the sidelines in fear. Financial organizations who recognize the power of DIs and include them in their strategic plans will hold a massive competitive advantage in the future of investing.

Go to this link to learn how and why Dynamic Investments will play a major role in the future of investing.