The Performance

of the NAOI “Alpha” Dynamic Investment

for the Period from 2008-2023

Dynamic Investments (DIs) have a built-in trading system that automatically signals trades based on a periodic sampling of market trends. This makes DIs “market-sensitive” and capable of producing returns that are higher than any ETF or mutual fund in existence today and with lower risk. As an example, shown below on this page are the returns of an NAOI-designed DI called the “Alpha” Dynamic Investment.

The NAOI “Alpha DI” Performance from 2008-2023

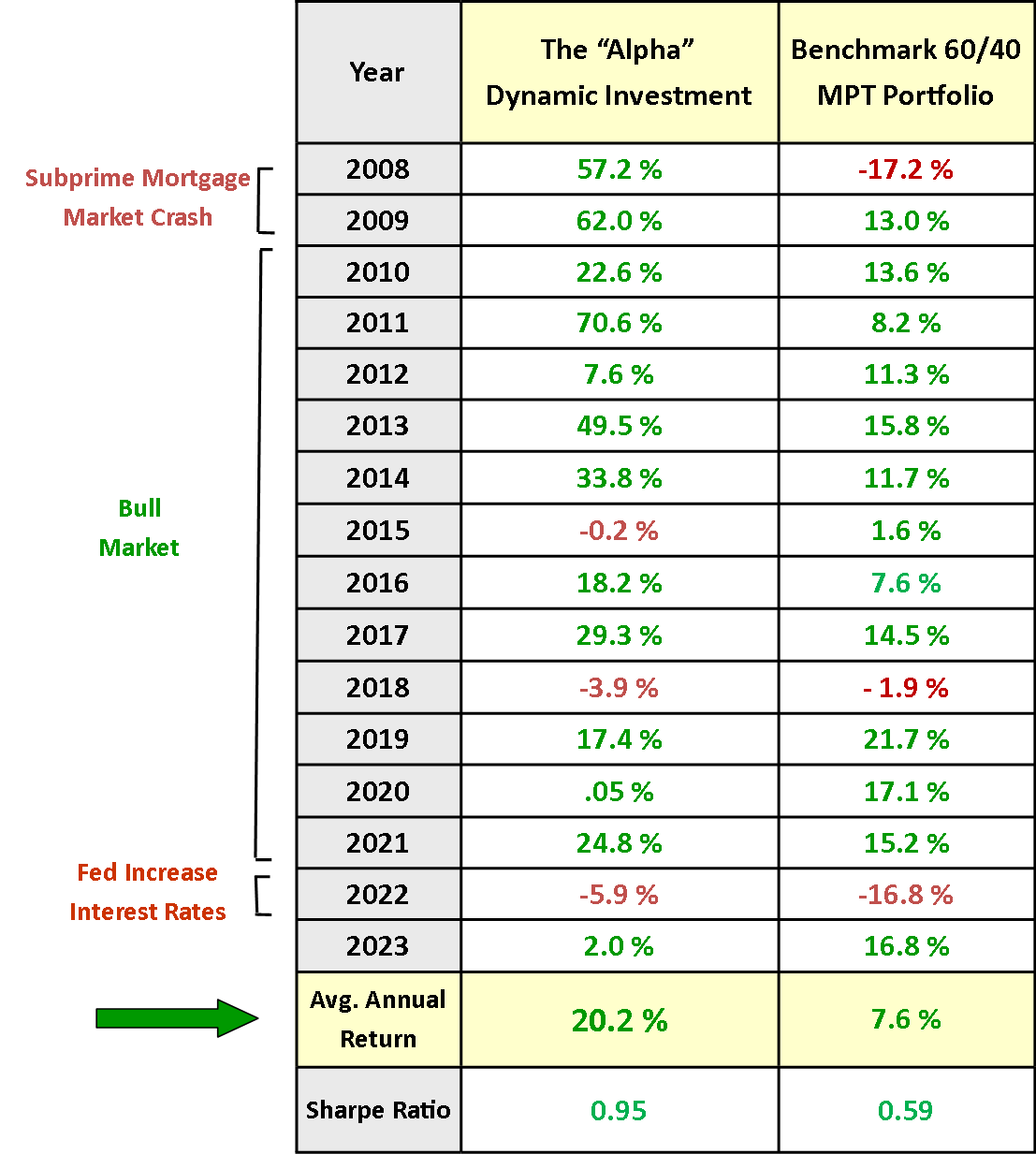

The table below shows the performance of a Dynamic Investment (DI) designed by the NAOI, called the Alpha DI, as compared to that of a 60% Stock / 40% Bond, MPT portfolio - the investment type offered to most investors today. The Alpha DI rotates among the ETFs that track the investment types listed just below, based on a quarterly sampling of the price trends of each. During this “review” event, only the ETF that has the strongest price uptrend is purchased, or retained if already owned, and held until the next quarterly review event.

A Large Cap Value Stock ETF

A Small Cap Growth Stock ETF

A Long-Term Government Bond ETF

A Momentum Factor ETF

The bottom two rows of the table show the Average Annual Returns for both the Alpha DI and the Generic MPT Portfolio along with their Sharpe Ratio - a measure of risk and the higher the better. The back-test period is from the start of 2008 to the end of 2022. Major market events are shown on the left side of the table.

You can see that the Dynamic Investment significantly outperformed the MPT portfolio in virtually all market conditions, even during the crash of 2008, while the MPT portfolio delivered only mediocre returns.

The year 2022 was bad for the entire market. Both Stocks and Bonds lost significant value. This was particularly damaging to the performance of MPT portfolios that rely on these two asset classes being negatively correlated. In contrast, while the DI did lose money in 2022, but its losses were substantially lower than the MPT portfolios as DIs do not rely Stock and Bond prices moving in opposite directions.

The Alpha DI Is Just One Example

Readers of the NAOI Research Report will be shown, step-by-step, how the Alpha DI was created and the specific ETFs used. And they can begin using it immediately. But more importantly, learning how this DI was designed enables readers to create an unlimited number of equally powerful DIs for a full range of investing goals.

“the future of investing starts HEre” is a registered service mark of Leland Hevner and the Naoi