The Rise of Dynamic Portfolios

The NAOI Recommended Investment Vehicle

While a single Dynamic Investment can be used as a total portfolio, the NAOI knows that allocating 100% of an investor’s money to one ETF at a time will not be easily accepted by either individuals or financial professionals. So, the NAOI is teaching individuals to use DIs as building blocks in the more familiar MPT portfolio format.

We call these investments Dynamic Portfolios (DPorts). They contain both a DIT, buy-and-sell Segment and an MPT, buy-and-hold Segment. This page shows how easily high-performance DPorts can designed and managed. And you will learn why the NAOI believes that they will dominate the future of investing.

The NAOI Dynamic Portfolio Configuration

Dynamic Portfolios are designed with both a DIT, buy-and-sell Segment and an MPT, buy-and-hold Segment as illustrated in the diagram below. NAOI trained DPort designers can easily change each of the allocation % values shown in this example to meet a client’s specific needs.

Testing by the NAOI shows that higher allocations to the DIT Segment and thus the Dynamic Investment(s) used, the higher the performance of the DPort will be.

The NAOI Universal Portfolio - A “Default” Recommendation

The NAOI strives to do more than just teach theory. Our goal is to empower investors to take action. For this purpose we recommend that our students consider the DPort configuration shown below as a starting point for their investing careers.

We have found that the following configuration and allocations works well for all investors regardless of their risk profile and in all economic conditions. Holders of this portfolio simply need to review the price trends of the ETFs in the Dynamic ETF Pool (DEP) of each Dynamic Investment use on a Quarterly basis and purchase, or retain if already held, the ETF with the strongest positive price trend.

We have called this investment vehicle the NAOI Universal Portfolio. We also show our students the specific types of ETFs that the NAOI recommends.

Many of our students look for advisors who offer, implement and manage this this type of portfolio. If they can’t find one that does, they can easily do so on their own using an online broker. The easy steps for doing so are provided in the Dynamic Investment User’s Manual currently available in the NAOI Store. This is the manual that we use in our investor education classes when teaching the use of DIs.

The NAOI Universal Portfolio Performance 2008-2022

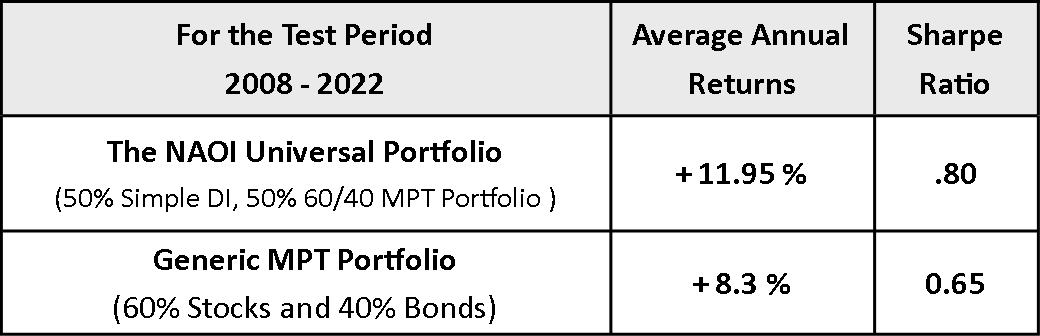

The table below shows the performance of the NAOI Universal Portfolio for the period from 2008-2022 as compared to a generic MPT portfolio with a 60% allocation to Stocks and a 40% allocation to Bonds.

While the returns of the NAOI Universal portfolio were not as high as that of the Simple Dynamic Investment, discussed at this link, the risk was significantly lower as shown by the higher Sharpe Ratio.

A New Portfolio Performance Benchmark

A major problem with the way investing works today is that their is no standard for portfolio performance that individuals can use to evaluate the effectiveness of the portfolios recommended to them by advisors. Now one exists in the form of the performance of the NAOI Universal Portfolio shown above.

A Non-Disruptive Enhancement to Current Operations

Some advisors and portfolio designers my say that the type of portfolio shown above is too disruptive to current operations and revenue streams to consider using. But a Dynamic Portfolio can be designed in such a manner that the DIT Segment simply “boosts” the performance of a traditional MPT portfolio as illustrated below. Adding a DI to any MPT portfolio will increase its returns AND lower its risk. As a result, the addition of a DI is not a major disruption to current operations.

Enabling FIVE Portfolio Diversification Factors!

A major reason why DPorts produce such superior returns is that while today’s MPT portfolios use two diversification factors, NAOI Dynamic Portfolios use five. They are as follows:

Company Diversification - via the use of ETFs (used by MPT and DIT)

Asset-Class Diversification - by working with multiple asset classes (used by MPT and DIT)

Time Diversification - by a DI’s ability to change the ETF owned periodically based the price trends of its ETF purchase candidates (used by DIT only)

Management Strategy Diversification - by including both MPT buy-and-hold methods and DIT buy-and-sell methods (used by DIT only)

Trade Catalysts -DPort trades are signaled by using both Objective Observations of Market Data (used by DIT) and Subjective Human Decisions (used by MPT).

It should be noted that the first two diversification elements listed above, used by both MPT and DIT, reduce risk but also reduce returns. Diversification elements 3, 4 and 5, used only by NAOI Dynamic Portfolios, not only reduce risk but also enhance returns! The use of five diversification elements in a portfolio is truly an evolutionary step forward in the world of investing.

Up Next - The Benefits of Using DIs for Individuals and Investing Professionals

If you have read the previous Web pages in this Dynamic Investing submenu, you now understand the tools and methods needed to make investing simpler, more profitable and less risky than it is today. The next step in the learning process is to identify the benefits that DIT and DIs bring to the both investment buyers and sellers. These benefits are discussed at this link.

"the future of investing starts here" is a registered trade mark of Leland Hevner and the national association of online investors