The World of ETFs Is About to Change

A major focus of NAOI Research and Development involves the use of Exchange Traded Funds (ETFs). We believe them to be one of the most significant developments in the world of investing since mutual funds were introduced. Yet, in our opinion they are massively under-used today. Are research shows that this is because the universal use of Modern Portfolio Theory to design portfolios suppresses their advantages. MPT methods embrace a buy-and-hold portfolio management strategy. ETFs shine in a buy-and-sell environment. This is the environment the NAOI Dynamic Investment Theory establishes.

Dynamic Investment Theory (DIT) and Dynamic Investments (DIs) will change the way we invest in many areas. Below we discuss how the use of Exchange Traded Funds (ETFs) will be revolutionized when the world of investing changes from static to dynamic investing methods, NAOI Dynamic Investments finally enable ETFs to come alive and realize their full potential as mainstream investments and not as the "quirky" mutual fund alternative they are seen as by the public today.

What are ETFs?

Exchange Traded Funds (ETFs) are a unique investment type. But most average investors that the NAOI interacts with haven't even heard of them. So, let's review what they are. ETFs are essentially mutual funds that trade like stocks. Advantages of ETFs include the following:

Easy to trade - just like stocks

Prices change continuously during the day - just like stocks

Lower expenses than mutual funds

Provides diversification to a portfolio - just like mutual funds

A wide variety of markets, market segments and asset types are targeted by at least one ETF

Availability of ETFs that "short" markets - e.g. there exist several ETFs that go up in price when the stock market goes down

Trades within an ETF are not taxed until the ETF is sold - unlike a mutual fund in which internal trades are taxed when they are made, not when the fund is sold

As of this writing there are approximately 1700 ETFs traded in the market. You can learn all about them at sites such as ETFdb.com.

Unleashing the Power of ETFs

ETFs are an extremely powerful investment type. They are investments that hold a groups of equities like mutual funds but have the benefit of trading like stocks, making them easy to buy and sell. But the full potential of ETFs is not being used today as they are typically bought as one component of a traditional MPT buy-and-hold portfolio. And because ETFs have low management fees, advisors are not likely to recommend them to clients. Mutual funds typically provide much higher commissions and fees. As a result, individuals view them today as little more than "quirky" mutual funds. This misconception ends with the introduction of Dynamic Investments.

In the future world of NAOI Dynamic Investments, ETFs will be free to shine. As you have read on this site, ETFs are the investment type of choice for use in building DIs. Each is designed with a Dynamic ETF Pool component that contains ETF candidates for purchase. At review time only the strongest uptrending ETF is bought and held until the next review. Because of their ease of trading and low costs, ETFs enable a DI to adjust its holding quickly, efficiently and inexpensively in response to market changes.

In the future world of dynamic investing the true power of ETFs is unleashed and investment returns that today's "experts" will say are impossible suddenly become probable.

Examples of ETF "Power" in a Dynamic World

Mutual funds thrive in the static world of buy-and-hold investing that most people are forced to deal with today. Modern Portfolio Theory advocates that a portfolio be held for the long term and not changed in response to changing market conditions. The static nature of MPT portfolios is why the public today holds portfolios that produce mediocre returns with high risk and excessive management fees. But in the NAOI future of investing, people will hold Dynamic Investments that automatically adjust the investments they hold to take advantage of market movements. This is an environment in which ETFs shine. Following are just a few examples of how.

Taming ETF Volatility

The market is rife with areas that hold the potential for exceptional returns;. ETFs exist that target virtually all of these areas. But the more narrow the focus of an ETF the more volatile it is likely to be. The potential for higher returns typically comes with the potential for higher volatility and significant losses. Thus, focused ETFs are not likely to be recommended by advisors for MPT portfolios because a buy-and-hold strategy offers no protection from the losses that these volatile investments can incur. As a result MPT portfolio holders are not able to capture significant returns that exist in the market somewhere at all times. NAOI Dynamic Investing solve the volatility problem and enable all investors, regardless of risk tolerance level, to capture these returns. Here is one example of how:

Profiting from China

PEK is an ETF that holds China stocks. It is a very volatile investment producing both extreme positive and negative returns. Because of its high risk profile, you will not find it in the MPT portfolios recommended to the public and its trading volume is low. Here is PEK's price chart for 2014-2015.

source: yahoo finance

You can see that PEK is a very volatile investment. But you can see the high returns potential as well. Using a buy and hold methodology during this period you would have watched PEK's price soar and then give most of it back.

By placing PEK in a Dynamic Investment structure you could have taken advantage of the price increase while avoiding the price drop. As you have read elsewhere on this site, each DI has a Dynamic ETF Pool (DEP) that holds investment "candidates" of which PEK could be one perhaps along with a total stock and a total bond ETF. Each DI also has a review period when the ETFs in the DEP are ranked to determine which is moving up in price most strongly. The one ETF that 'wins" is then bought and held until the next review period. Each DI also places a Trailing Stop Loss order on the ETF purchased that will automatically sell it should if fall dramatically during its short holding period. Placed in the Dynamic Investment structure we can call this China-stocks ETF "Dynamic PEK", a term used in the following returns table.

Returns for Dynamic PEK

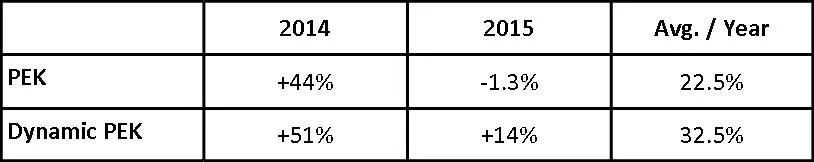

The following table compares the returns for the period shown in the chart of just buying and holding PEK with the returns of a Dynamic Investment with PEK in its DEP (Dynamic PEK).

You can easily see how making PEK "dynamic" allowed an investor to take advantage of its significant returns upside potential by buying it only when it is trending up and selling it when it starts to drop in price. Thus, DIs give life to volatile, but valuable, ETFs that would otherwise fade away with no trading volume in an MPT-based, buy-and-hold environment.

A Boon for Portfolio Managers and Strategists

Dynamic Investments / ETFs give portfolio managers and strategists an amazing new array of tools for meeting the goals of their clients and their companies. These are flexible investments enable portfolio designers and managers to take advantage of any ETF's upside potential without worrying about its downside risk!

With Dynamic Investments portfolio managers can now put assets like commodities, gold, emerging markets, single countries stocks and even the volatile healthcare market into their portfolios without fear. Portfolio managers who take advantage of this approach will show significantly increased performance from their efforts. Those who don't will fare poorly in comparison.

Uncovering Hidden Value in ETF Product Lines

Now let's look at another way in which Dynamic Investments can change the very nature of how we invest.

Many financial organizations offer an extensive line of ETF offerings today. Using traditional investing methods they are sold much like mutual funds as one component of an MPT portfolio. But by selling each as an individual ETF buy and hold product, companies are not ignoring significant value that their product line holds. This is the value that can be realized by combining these ETFs in the Dynamic ETF Pool (DEP) of an NAOI Dynamic Investment.

For example: - iShares by Blackrock offers scores of ETFs that enable the public to invest in virtually every corner of the market. Here are just a ETFs in the iShare product line few that I will use in this example:

IVV - S&P 500 Index ETF

IJR - S&P Small Cap 600 Index ETF

TLT - Barclay's Long Term Treasury Bond ETF

Typically such ETFs are sold for the purpose of being included in an MPT portfolio. But they hold far greater value than that. To truly unlock the value of these three ETFs they can also be combined in the DEP of a Dynamic Investment. Let's look at how this value is unlocked.

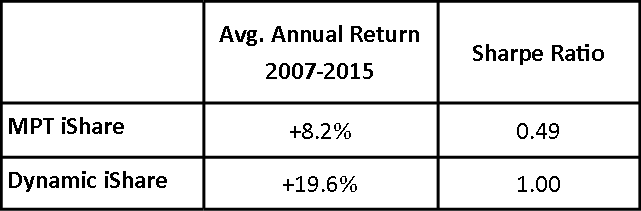

First let's create an MPT, asset-allocation portfolio that gives 33.3% allocation to each of these ETFs and then is just bought and held. The returns and Sharpe Ratio (a measure of Risk) for this portfolio during the period from 2007 to 2014 are shown in the top line of the table below. This is how ETFs are used today - as part of an MPT, buy-and-hold portfolio and you can see that performance is mediocre at best.

Next let's create a Dynamic Investment that holds all three ETFs in its DEP and buy-and-hold this DI for the backtest period. The performance is shown in the bottom line of the table.

The Dynamic iShare that rotates among the three ETFs based on market conditions. You can see that the returns, using the same ETFs, is astounding. This simple example shows the power of Dynamic Investments to create value in an ETF product line that did not previously exist. Thus the NAOI's claim that Dynamic Investments can multiply the value of an ETF product line exponentially and with very little effort.

Enabling ETFs to Dominate the 401(k) Industry

NAOI surveys of the general investing public show that 401(k) Plan participants are woefully under-educated about their plans. Many, if not most, do not know exactly what they own or why. They have simply bought MPT based portfolios recommended by an advisor and told to buy and hold. This results in 401(k) Plans that produce very mediocre returns, with high risk and high expenses. And after their plans crashed in 2008 participants have reason to worry about their plan's value when markets start to slide.

The introduction of Dynamic Investments (DIs) goes a long way to solving these problems and in the process enabling ETFs to dominate this huge industry. A 401(k) participant can simply buy a basic DI that periodically checks market conditions and automatically adjusts the ETF it holds to take advantage of the price trends it detects. ETFs enable this type of investing power far better than do mutual funds because of their trading ease, low trading costs and wide variety of markets they cover.

Also, NAOI Hybrid Portfolios are an excellent choice to be the standard "default" investment for the entire 401(k) industry. These are portfolios that have as their goal high returns with low risk and absolute crash protection. They meet the goals of everyone regardless of their age, time to retirement or risk profile. And since DIs automatically change their holding to take advantage of market conditions there is no pressure to manually review and re-balance them on a regular basis - an activity that is sorely missing in today's 401k environment. Even the simplest Dynamic Investment is a far superior default 401k investment than the disastrous "Target Date" fund/ETF that is used as a default investment today. Many Target Date ETFs and Funds have performed so poorly that they have been pulled from the market altogether.

The 401k market is a multi-billion dollar opportunity just waiting for companies to inject bold new ideas and products. The NAOI has given the financial industry the bold, new investment type needed to take advantage of this opportunity. The first organization that does so will become unreasonably prosperous.

A Boon for ETF Developers

The field of Dynamic Investments represents a vast, virgin field of opportunity for investment developers. There are an unlimited number of DIs that can be created for an unlimited number of goals. And each new and better DI that is developed can become a very valuable asset on the balance sheet of the creating organization and the source of a significant new stream of revenue as they can be sold to the public or licensed to other companies much as ETFs or Market Indexes are today.

Plus, DIs do not need to be time consuming or expensive to create. Any organization that currently owns or sells a line of ETFs can create new DIs by simply combining ETFs they currently offer in the Dynamic ETF Pool of a Dynamic Investment as discussed above in the iShares example. All that's needed is training on how to do so. For this purpose the NAOI offers the "Dynamic Investment Design and Creation Class" that is described in the Products section of this site.

Just One Area of Dramatic Change

This section could go on and on. The revitalization of Exchange Traded Funds is just one area where change will be dramatic with the introduction of Dynamic Investing methods.

When the world of investing changes from "static" to "dynamic" in the logical manner provided by NAOI Dynamic Investment Theory, performance that today's "experts" will say is impossible suddenly becomes probable. Such is the power of this much needed step forward in the evolution of investing.